gsrkro.site

Tools

What Is Considered Payroll Taxes

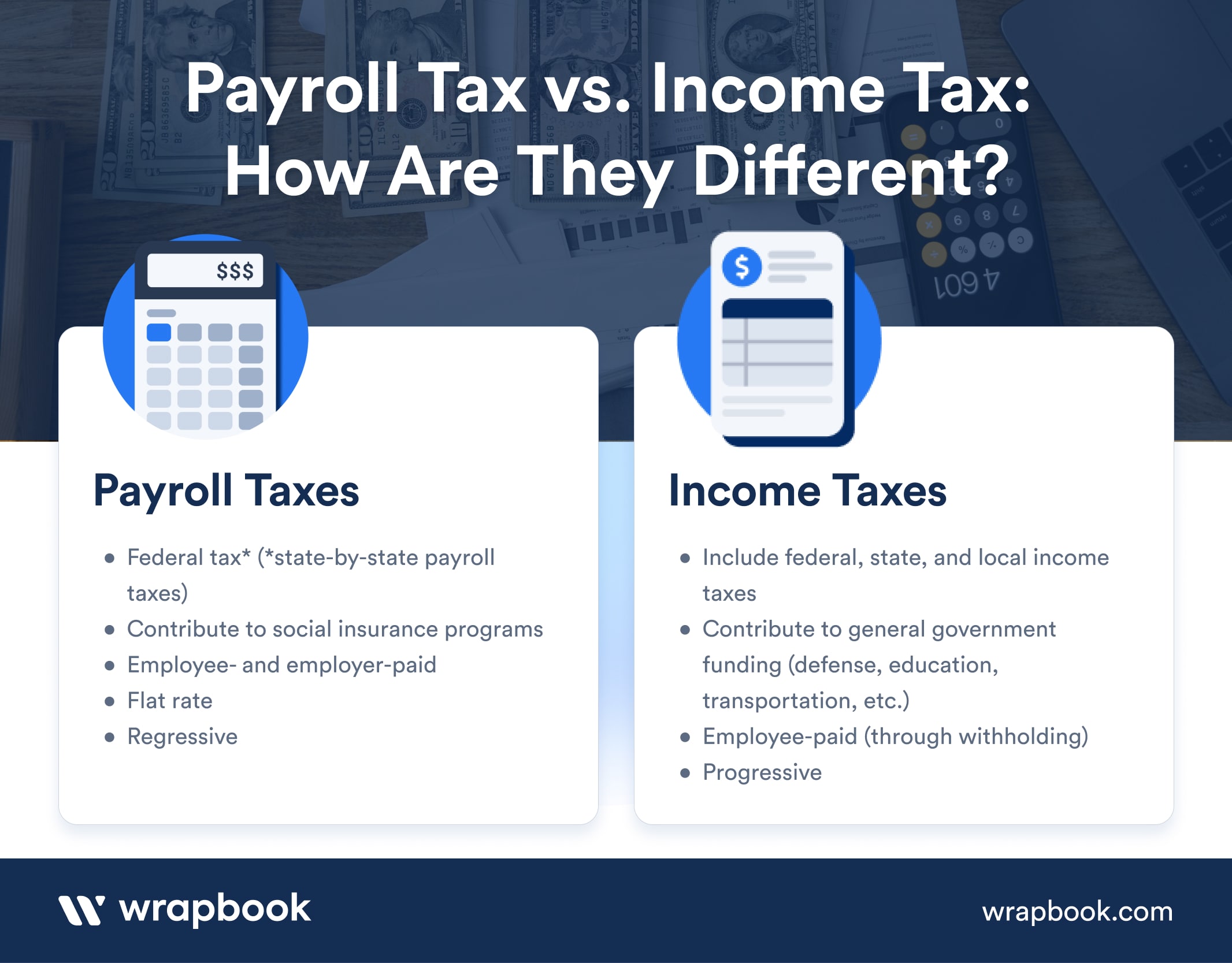

Payroll taxes are taxes that are levied on employees and employers and calculated based on employee salaries and wages. In the case of employee payroll taxes. Payroll taxes are taxes that both employees and employers pay based on employees' wages They are not considered payroll taxes and have no corresponding. The federal unemployment tax rate ranges from to 6%, depending on how much the employer pays in state unemployment tax. It is paid only by employers. Unlike income tax, which can be used by the federal government in a variety of ways, payroll taxes are used specifically to fund social service programs in the. The federal unemployment tax rate ranges from to 6%, depending on how much the employer pays in state unemployment tax. It is paid only by employers. Along with actually depositing your federal payroll taxes, you also have an obligation to file periodic returns that show how you computed your tax liabilities. The total Social Security tax rate is %. If you are an employee, you are only responsible for paying % of your paycheck and your employer pays the other. Wage caps and floors. The definition of taxable wages is basically the same for each of the different payroll taxes. What this means is that a specific type of. Payroll taxes are taxes that both employees and employers pay based on employees' wages, tips, commissions and salaries. Payroll taxes are taxes that are levied on employees and employers and calculated based on employee salaries and wages. In the case of employee payroll taxes. Payroll taxes are taxes that both employees and employers pay based on employees' wages They are not considered payroll taxes and have no corresponding. The federal unemployment tax rate ranges from to 6%, depending on how much the employer pays in state unemployment tax. It is paid only by employers. Unlike income tax, which can be used by the federal government in a variety of ways, payroll taxes are used specifically to fund social service programs in the. The federal unemployment tax rate ranges from to 6%, depending on how much the employer pays in state unemployment tax. It is paid only by employers. Along with actually depositing your federal payroll taxes, you also have an obligation to file periodic returns that show how you computed your tax liabilities. The total Social Security tax rate is %. If you are an employee, you are only responsible for paying % of your paycheck and your employer pays the other. Wage caps and floors. The definition of taxable wages is basically the same for each of the different payroll taxes. What this means is that a specific type of. Payroll taxes are taxes that both employees and employers pay based on employees' wages, tips, commissions and salaries.

Employees Are Not Liable For Employer Fraud: If your employer withholds taxes from your earned income, but does not pay these taxes to the IRS, you do not have. Employees Are Not Liable For Employer Fraud: If your employer withholds taxes from your earned income, but does not pay these taxes to the IRS, you do not have. All paycheck stubs show your gross pay — the total amount you earned before any taxes were withheld for the pay period. They also show your net pay. A payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security and Medicare. Federal Unemployment Tax Act (FUTA) taxes are only paid by employers, at a rate of 6 percent for the first $7, of earned income per employee. FUTA taxes. The total Social Security tax rate is %. If you are an employee, you are only responsible for paying % of your paycheck and your employer pays the other. The employer's Medicare tax is considered to be an expense for the employer. For the year , the employer's portion of the Medicare tax is the same rate as. Employers and employees generally share this tax liability, but in some cases, only the employer is responsible. What is a taxable employee? Taxable employees. All state and federal employer payroll taxes will generally deductible on your Schedule C. Here's what you should know about payroll tax deductions. What Is Payroll Tax? Payroll tax is a levy imposed on both employers and employees, which consists of Social Security, Medicare, and unemployment taxes. As an. Employer payroll taxes are the taxes withheld from an employee's paycheck that companies are responsible for paying to the government. Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. Employers withhold (or deduct) some of their employees' pay in order to cover payroll taxes and income tax. Money may also be deducted, or subtracted, from. FICA is a U.S. federal payroll tax. It stands for the. Federal Insurance As you work and pay. FICA taxes, you earn credits for Social Security benefits. What Are Payroll Taxes? Payroll taxes consist of income taxes (federal, state, and sometimes local) and FICA taxes (Social Security and Medicare). · What Is the. Depositing and reporting employment taxes. You must deposit federal income tax and Additional Medicare Tax withheld and both the employer and employee social. considered wages and are not included in the calculations of withholding tax. See IRS Publication 15, Circular E, for details. Supplemental Wages. FUTA taxes are calculated by multiplying % times the employer's taxable wages. The taxable wage base is the first $7, paid in wages to each employee. Payroll tax and income tax are the most common employment taxes. Understanding the differences between them and making sure you manage withholding properly. Federal Insurance Contributions Act (FICA) under 26 U.S.C. § (),), is the statutory authority for the payroll deduction of federal tax payments from.

How Much Do Business Get Charged For Credit Cards

If you're looking for quick numbers, here you go: the average credit card processing cost for a retail business where cards are swiped is roughly % – 2% for. Make your tax payments by credit or debit card. You can pay online, by phone or by mobile device no matter how you file. Learn your options and fees that. But if you're just looking for a general overview, the average costs for credit card processing ranges from % to % for swiped cards, and % for keyed-in. To simplify the cost for merchants, credit card companies compute interchange into flat rate plus a percentage of the sales total (including taxes). In the U.S. On average, credit card processing fees can range between % and %. Fees can be charged per transaction, per month or per year depending on the credit. Businesses can make a charge The Regulations do not specify any maximum amounts as the costs should reflect the actual cost to the individual business of. charge the actual cost the company pays for credit processing. Because credit card payment rule that businesses should be aware of. Put simply, if. When you sell with us, you can get some of the most competitive rates in the business. With either, your customers can pay by credit card without leaving your. The bulk of your business credit card charges boil down to the merchant service charge (MSC), covering the cost of processing payments. This is the transaction. If you're looking for quick numbers, here you go: the average credit card processing cost for a retail business where cards are swiped is roughly % – 2% for. Make your tax payments by credit or debit card. You can pay online, by phone or by mobile device no matter how you file. Learn your options and fees that. But if you're just looking for a general overview, the average costs for credit card processing ranges from % to % for swiped cards, and % for keyed-in. To simplify the cost for merchants, credit card companies compute interchange into flat rate plus a percentage of the sales total (including taxes). In the U.S. On average, credit card processing fees can range between % and %. Fees can be charged per transaction, per month or per year depending on the credit. Businesses can make a charge The Regulations do not specify any maximum amounts as the costs should reflect the actual cost to the individual business of. charge the actual cost the company pays for credit processing. Because credit card payment rule that businesses should be aware of. Put simply, if. When you sell with us, you can get some of the most competitive rates in the business. With either, your customers can pay by credit card without leaving your. The bulk of your business credit card charges boil down to the merchant service charge (MSC), covering the cost of processing payments. This is the transaction.

Credit cards have no similar cap, so their rates may (and do) go up over time. Given the choice, then, it's to your benefit as a merchant for a customer to pay. This fee is usually $$30 a month or higher. If you see this fee on your statement, call your merchant service provider to find out what steps you must take. In most cases, credit card processing fees will run between % to 4% of the total value of a transaction. A $1, transaction, therefore, could have fees. But if you're just looking for a general overview, the average costs for credit card processing ranges from % to % for swiped cards, and % for keyed-in. This rule stipulates that you cannot use surcharging as a means to make a profit. In general, a surcharge cannot exceed 3% in the U.S. In Colorado, merchants. Merchant service charge (MSC) · Debit cards: % to % · Credit cards: % to % · Commercial credit cards: % to %. Credit card companies do not allow governments and businesses to pass on the Accordingly, they should not be required to absorb usage fees in their. As a result, most credit card companies prohibit merchants from surcharging debit card transactions. Are businesses required to disclose a credit card surcharge. Businesses are not permitted to impose surcharges for paying by debit card, credit card or electronic payment services (this ban does not apply to commercial. Need-to-Know Facts About Square's Payment Processing Fees · Credit card fees are included in Square's fees, so there are no charges from credit card companies. That surcharge structure allows merchants to add fees as high as 4% to consumer transactions—though the exact amount charged varies from business to business. To complete payment processing, credit card companies have to charge processing fees. Also referred to as swipe fees, these are simply fees that the merchant. A business's average cost of acceptance for Visa debit is 1% and for Visa credit is %. If the business wanted to charge the same level of surcharge for each. They usually get charged a fixed fee (rather than a percentage) per transaction. On amounts less than - that can be a sizeable 'chunk' of. PCI compliance is $ per year on average, although some companies may prorate it and charge it monthly, sometimes including it into the monthly fee. The. No matter the transaction type – credit card, debit card, reward card – the fees are the same. These are typically charged with a percentage as well as a per-. An estimate of how long it can take to pay off your credit card balance if If your credit card company is going to raise interest rates or fees or make. credit history and affects how much you will pay to get credit. When it pay back, they'll generally feel more confident doing business with you. A cash advance fee refers to using your credit card to take out cash. Credit cards typically charge 3% to 5% for each cash advance. In addition, you'll also be. Technically, according to Visa and Mastercard rules, businesses should already be limiting the surcharge to their actual cost of processing (or not more than 3%.

Canadian Non Resident Tax Return Form

income up to $73, Related Information. U.S. Income Tax Basics · Filing Your Non-Resident Tax Forms · TLA - Canadian Tuition Receipt · W-2 Information. will have to file a completed Form T, Disability Tax Credit Certificate, with your Canadian income tax return. Section 7 – Dependent information. If you. Which Form to File. Nonresident aliens who are required to file an income tax return must use Form NR, U.S. Nonresident Alien Income Tax Return. When. When are Canada taxes due? In Canada, the tax year is the calendar year, and the deadline for most individuals to file their income tax return is April 30th of. The NR6 Form is a Canada Revenue Agency (CRA) document that a non-resident who has received a rent or timber royalty payment in Canada must submit to the agency. Canada imposes corporate and personal income tax on its residents (including Canadian subsidiaries of foreign entities) in respect of income and capital. Use this form to apply for an individual tax number (ITN) from the Canada Revenue Agency (CRA). An ITN is a nine-digit number issued to non-resident individuals. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. Provides an all-in-one solution covering tax return forms for non-resident individuals in Canada · Offers automatic generation of completed tax return forms. income up to $73, Related Information. U.S. Income Tax Basics · Filing Your Non-Resident Tax Forms · TLA - Canadian Tuition Receipt · W-2 Information. will have to file a completed Form T, Disability Tax Credit Certificate, with your Canadian income tax return. Section 7 – Dependent information. If you. Which Form to File. Nonresident aliens who are required to file an income tax return must use Form NR, U.S. Nonresident Alien Income Tax Return. When. When are Canada taxes due? In Canada, the tax year is the calendar year, and the deadline for most individuals to file their income tax return is April 30th of. The NR6 Form is a Canada Revenue Agency (CRA) document that a non-resident who has received a rent or timber royalty payment in Canada must submit to the agency. Canada imposes corporate and personal income tax on its residents (including Canadian subsidiaries of foreign entities) in respect of income and capital. Use this form to apply for an individual tax number (ITN) from the Canada Revenue Agency (CRA). An ITN is a nine-digit number issued to non-resident individuals. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. Provides an all-in-one solution covering tax return forms for non-resident individuals in Canada · Offers automatic generation of completed tax return forms.

All F and M students that study in the United States need a Form I, “Certificate of Eligibility for Nonimmigrant Student Status. (b) Canadian Residents Providing Self Employed Personal Services in the U.S. · U.S. NR Nonresident Alien Individual tax return · Form - Disclosure of. If converting to a rental property, consideration should be given to file Form NR6 (before rental income commences) so the 25% non-resident withholding tax can. When you carry on business in Canada, you have to file a Canadian corporate income tax return (T2). The Regulation 15% withholdings are recorded as a tax. NR4 - Non-resident tax withholding, remitting, and reporting.: RvE-PDF "This guide gives information for payers and agents who make payments to non-. TurboTax® provides all the tax forms you need, based on your tax situation. Find all the Canadian federal and provincial tax forms. If you earned income, you need an ITIN or SSN to file your tax forms. If you have neither, please check these sites for more information on how to apply for a. Canada or Mexico if you regularly commute from Canada or Mexico. You'll file a Form , U.S. Individual Income Tax Return or Form SR, U.S. Tax Return. To receive an ITN, you must complete Form T Application for a Canada Revenue Agency Individual Tax Number (ITN) for Non-Residents. Income tax slips like T4. If you depart Canada and become a non-resident part way through the calendar year, you must file a resident. Canadian tax return reporting your worldwide income. Your tax filing obligations in Canada depend on whether you are a resident or non-resident. Canadian residents have to pay tax on their worldwide income. There. Non-Resident Waiver and Filing. Non-resident individuals and corporations who render services in Canada (other than in the course of regular and continuous. Form NR6 is a Canadian tax form for non-residents receiving rental income or timber royalties. · The CRA defines a non-resident as an individual who resides in. If you are a non resident Canadian you have to file a special tax return file Form R T1 (Income Tax and Benefit Return for Non-Residents and Deemed. Income Tax Return) and Form NR (Maryland Nonresident Income Tax Calculation). Only U.S. nationals and residents of Canada, Mexico, and the Republic. A spreadsheet return is not an approved and acceptable tax form. Unapproved tax forms filed with the department may be rejected and returned to the taxpayer or. If you are a resident of one of the following states, U.S. possession, or Canadian provinces or territory, you may be able to apply for a Washington state. In addition, they'll be required to file the T or departure tax return form. The form is for people who ceased to be a resident of Canada in the year and. If you earned income, you need an ITIN or SSN to file your tax forms. If you have neither, please check these sites for more information on how to apply for a. Follow the instructions below that apply to you as a non-resident of Canada or as a Canadian resident. Include with your completed form a copy of any.

Betting Sites For Esports

Esports betting allows you to redeem bonuses, place wagers, and watch competitive video gaming action unfold. The experts at gsrkro.site have put together this comprehensive guide to the best esports bookies, sign-up bonuses, promotions, and more. Rivalry is an esports betting platform made by gamers for gamers. If you're looking to bet on esports, you've come to the right place, step inside. Bookies with the best odds for eSports include Bovada, gsrkro.site, BetOnline, and BetUS. These betting sites have competitive odds overall with the. Parimatch offers legal esports betting, as well as traditional sports betting on various other sports, including ice hockey, cricket bet online, badminton, and. After comparing the odds for 15 tournaments across 50+ sportsbooks, we have concluded that Bovada offers the most value for your eSports bets and the most. Step inside the only esports betting site you'll ever need, featuring lightning-fast payments, extensive markets, and top esports odds. Our eSports betting guide covers the biggest leagues and teams on the scene now. Try some special eSports bets and win real money from our recommended eSports. From the guys who allowed you to watch CS:GO in your teenage years without your parents finding out, Strafe is now your best buddy for esports betting. Esports betting allows you to redeem bonuses, place wagers, and watch competitive video gaming action unfold. The experts at gsrkro.site have put together this comprehensive guide to the best esports bookies, sign-up bonuses, promotions, and more. Rivalry is an esports betting platform made by gamers for gamers. If you're looking to bet on esports, you've come to the right place, step inside. Bookies with the best odds for eSports include Bovada, gsrkro.site, BetOnline, and BetUS. These betting sites have competitive odds overall with the. Parimatch offers legal esports betting, as well as traditional sports betting on various other sports, including ice hockey, cricket bet online, badminton, and. After comparing the odds for 15 tournaments across 50+ sportsbooks, we have concluded that Bovada offers the most value for your eSports bets and the most. Step inside the only esports betting site you'll ever need, featuring lightning-fast payments, extensive markets, and top esports odds. Our eSports betting guide covers the biggest leagues and teams on the scene now. Try some special eSports bets and win real money from our recommended eSports. From the guys who allowed you to watch CS:GO in your teenage years without your parents finding out, Strafe is now your best buddy for esports betting.

When it comes to esports betting, bet is a name that often comes up, and for good reason. This site is renowned for offering enhanced odds, which means you. In this guide, we're going to look at the top eSports betting sites! With so much to learn, we've broken down everything you need to know. The best betting sites for esports as we list the UK's best online bookmakers from the best sign-up offer to the best markets and games. Explore a world of eSports betting at Ladbrokes. Bet on your favourite teams and players in thrilling online gaming tournaments. Join us today. All of that said there are a handful of "reputable" unregulated offshore gambling sites with a solid enough track record that I wouldn't lose. How does esports betting work? · Real-money, fixed-odds betting through an online betting site · Social betting between individuals arranged privately · Skin. We list the best esports betting sites for UK punters, and our comprehensive guide includes information on everything from popular esports titles to common. gsrkro.site is an eSports bookmaker based in Curacao that accepts various altcoins and BTC deposits. The platform's casino invitingly offers you its best table. A curated list of awesome esport betting sites – live, statistics and other resources. CC license 21 stars 3 forks. BetRivers is a big name in gambling, home to everything from sports Sports bonus, Second chance bet up to $ Promo code, Yes, use "SPORTS". Our best online esports betting sites for only include regulated and legal bookmakers and must have extensive odds available for competitive video gaming. Vave, Mega Dice, Stake, 1xBit, and gsrkro.site are the best eSports crypto betting sites in as per our experts. Compare the most recommended esports gambling sites available · Great search function · Solid live odds · Good variety of markets · Almost 50% Cashback. Again, these games (at least within an esports-dominated frame) are only available at skin betting sites. The market for these (and all) skin betting products. If you're looking for good esports betting sites, check out our list. It contains only the best sites that were thoroughly tested by our experts. Are you looking for eSports bookies that accept crypto? Here at gsrkro.site, we have listed and compared the best Bitcoin eSports betting websites! Esports betting refers to the act of placing wagers on competitive video gaming events. It involves predicting the outcomes of Esports matches or tournaments. It's just not possible to bet in most countries since esports betting is considered gambling, including in the US and most of Europe, apart from the UK. Esports betting at Betway! Bet online on CSGO, Dota 2, LoL (League of Legends) and more. Placing a bet on Esports has never been so easy. Bet with the best. eSports betting is legal for those who live in a country where betting is legal, and are above the legal age, usually 18+.

Running An Online Store

An e-commerce site can be a simple one- or two-page site offering a handful of products. You can build upon the site as you grow. Born in the Swiss Alps, On running shoes feature the first patented cushioning system which is activated only when you need it - during the landing. How to Start an Online Store · 1. Define your eCommerce plan. · 2. Choose an eCommerce platform. · 3. Customize your online store layout. · 4. Photograph items and. The Complete Online Print Business Guide · 1. Decide your selling method · 2. Choose your print-on-demand products and find a niche · 3. Decide what to sell. Building an online store is a challenging task. it is required to be more attractive and fully responsive so that people will trust on your. We've written this step-by-step guide with everything you need to know about successfully launching an online business. Here's how to start an online business (seriously) by launching an ecommerce store in No shortcuts, no hacks. Just hard work and smart planning. Shop the largest selection of men's running shoes, clothing, and gear at Running Warehouse. Dedicated to providing the best shopping experience for your. Running an online retail company is not that hard. All you have to do is advertise your business, handle your customers' orders, ship the. An e-commerce site can be a simple one- or two-page site offering a handful of products. You can build upon the site as you grow. Born in the Swiss Alps, On running shoes feature the first patented cushioning system which is activated only when you need it - during the landing. How to Start an Online Store · 1. Define your eCommerce plan. · 2. Choose an eCommerce platform. · 3. Customize your online store layout. · 4. Photograph items and. The Complete Online Print Business Guide · 1. Decide your selling method · 2. Choose your print-on-demand products and find a niche · 3. Decide what to sell. Building an online store is a challenging task. it is required to be more attractive and fully responsive so that people will trust on your. We've written this step-by-step guide with everything you need to know about successfully launching an online business. Here's how to start an online business (seriously) by launching an ecommerce store in No shortcuts, no hacks. Just hard work and smart planning. Shop the largest selection of men's running shoes, clothing, and gear at Running Warehouse. Dedicated to providing the best shopping experience for your. Running an online retail company is not that hard. All you have to do is advertise your business, handle your customers' orders, ship the.

From setting up an ecommerce business to offering web design services, there are countless avenues to explore as an entrepreneur. In this post, you'll learn how to pick a niche, select a platform to house your store, and everything in between. Get everything you need to build, run and scale your business—on one unified platform. Create Your Store. Jotform's Online Store Builder lets you create your online store to sell products, services, subscriptions or collect donations with 25+ payment gateways. Building an online store is a challenging task. it is required to be more attractive and fully responsive so that people will trust on your online store. How to start an online store in 10 steps · Determine your target audience · Choose what to sell online · Decide on your business structure · Shop superior running shoes and apparel for men and women with free shipping and returns website by sliding the toggle below to the left and then. If you know how to make your side hustle work for you, you can achieve full-time results in part-time hours. In fact, you can run a successful e-commerce. Tips and Tricks to running an online retail store? · the key here is to really know your suppliers. · social media, especially platforms like. We've put together a killer step guide that will walk you through everything from A to Z on how to launch and grow your online boutique in Anyone can start and scale an online business, regardless of professional background or past entrepreneurial experience. Test run your shoes for 90 days & earn Rewards Cash when you join the VIP Family. 90 Day Test Run. Online Fit Experts. VIP Savings. Free Shipping. Discover premium athletic footwear for men and women at Fit2Run. Shop top brands and find your perfect fit with our wide selection. Visit us today. Conduct market research; Choose the right platform for your store; Create a basic online store; Choose an eye-catching domain; Add products to your inventory. This store isn't about shoes, it's about people. Fast or slow, LET'S GO!!! You need little more than a website, a nice online store theme, and a little bit of know-how in the marketing department. That's it. Set up a Shopify store like an expert with this guide to ecommerce for modern manufacturers selling online store is running smoothly. You learned how. The benefits of existing ecommerce platforms are enormous if you look at some great examples of successful online stores such as Shopify or even Amazon. The. This post is a comprehensive tutorial that will teach you how to start an online store or boutique in 6 simple steps. Online store of running and triathlon material. Find running shoes and clothing at Runnerinn | Minimum price guaranteed.

Books Written By Robert Kiyosaki

gsrkro.site book is rich dad poor dad which is world wide famous. · gsrkro.sitent cash flow · gsrkro.site business of the 21st century · gsrkro.site to investing. Robert Kiyosaki Book Recommendations (All-Time) · Book 1 - Think and Grow Rich by Napoleon Hill · Book 2 - The Law of Success by Napoleon Hill · Book 3 - The Story. Robert T. Kiyosaki has books on Goodreads with ratings. Robert T. Kiyosaki's most popular book is Rich Dad, Poor Dad. (Book #1 in the Rich Dad Series) · You Might Also Enjoy · Book Overview · Customer Reviews · Rich Dad, Poor Dad Mentions in Our Blog · Based on Your Recent Browsing. Rich Dad's Conspiracy of the Rich: The 8 New Rules of Money by Kiyosaki, Robert T. and a great selection of related books, art and collectibles available. Best known as the author of Rich Dad Poor Dad—the #1 personal finance book of all time—Robert Kiyosaki has challenged and changed the way tens of millions of. Books by Robert T. Kiyosaki and Complete Book Reviews ; Rich Dad's Conspiracy of the Rich: The 8 New Rules of Money ; Why A Students Work for C Students and B. Publication Order of Non-Fiction Books ; More Important Than Money, (), Description / Buy at Amazon ; Why the Rich Are Getting Richer, (), Description /. Robert Kiyosaki, author of Rich Dad Poor Dad - the international runaway bestseller that has held a top spot on the New York Times bestsellers list for over. gsrkro.site book is rich dad poor dad which is world wide famous. · gsrkro.sitent cash flow · gsrkro.site business of the 21st century · gsrkro.site to investing. Robert Kiyosaki Book Recommendations (All-Time) · Book 1 - Think and Grow Rich by Napoleon Hill · Book 2 - The Law of Success by Napoleon Hill · Book 3 - The Story. Robert T. Kiyosaki has books on Goodreads with ratings. Robert T. Kiyosaki's most popular book is Rich Dad, Poor Dad. (Book #1 in the Rich Dad Series) · You Might Also Enjoy · Book Overview · Customer Reviews · Rich Dad, Poor Dad Mentions in Our Blog · Based on Your Recent Browsing. Rich Dad's Conspiracy of the Rich: The 8 New Rules of Money by Kiyosaki, Robert T. and a great selection of related books, art and collectibles available. Best known as the author of Rich Dad Poor Dad—the #1 personal finance book of all time—Robert Kiyosaki has challenged and changed the way tens of millions of. Books by Robert T. Kiyosaki and Complete Book Reviews ; Rich Dad's Conspiracy of the Rich: The 8 New Rules of Money ; Why A Students Work for C Students and B. Publication Order of Non-Fiction Books ; More Important Than Money, (), Description / Buy at Amazon ; Why the Rich Are Getting Richer, (), Description /. Robert Kiyosaki, author of Rich Dad Poor Dad - the international runaway bestseller that has held a top spot on the New York Times bestsellers list for over.

Quick Look: The Best Robert Kiyosaki Books · Cashflow Quadrant: Rich Dad's Guide to Financial Freedom - Buy it now · Rich Dad's Guide to Investing: What the Rich. Showing products written by Kiyosaki, Robert T. · Rich Dad's Prophecy: Why the Biggest Stock Market Crash in History Is Still Coming. · Rich Dad's Retire Young. Best-seller author Robert T. Kiyosaki, in his book Rich Dad's Guide to Investing: What the Rich Invest in, That the Poor and the Middle Class Do Not!. Best known as the author of Rich Dad Poor Dad--the #1 personal finance book of all time--Robert Kiyosaki has challenged and changed the way tens of millions of. Business and financial advice Kiyosaki has authored more than 26 books including Rich Dad Poor Dad, which has been translated into 51 languages and sold over. "In Rich Dad Poor Dad, the #1 Personal Finance book of all time, Robert Kiyosaki shares the story of his two dad: his real father, whom he calls his?poor dad,'. Rich Dad's Escape the Rat Race: Learn How Money Works and Become a Rich Kid. by. Robert T Kiyosaki Books in Order (39 Book Series) · 1. Robert Kiyosaki is an entrepreneur, educator, investor, and the author of Rich Dad Poor Dad, one of the best-selling personal finance books of all time. Robert Kiyosaki books · Why the Rich Are Getting Richer · Rich Dad Poor Dad · Frequently asked questions · Who is Robert Kiyosaki? · How many books written by. Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! by Robert T. Kiyosaki · out of 5 stars. (99,). gsrkro.site book is rich dad poor dad which is world wide famous. · gsrkro.sitent cash flow · gsrkro.site business of the 21st century · gsrkro.site to investing. Rich Dad's Guide To Becoming Rich Without Cutting 1, Robert T Kiyosaki. from $ Showing results by author "Robert Kiyosaki" in All Categories ; Rich Dad Poor Dad: 20th Anniversary Edition · Narrated by: Tom Parks; Length. Rich Dad Poor Dad is considered the best Robert Kiyosaki book and one of the most outstanding personal finance books of all time. Unwrap a complete list of books by Robert T. Kiyosaki and find books available for swap. It has since become the #1 Personal Finance book of all time translated into dozens of languages and sold around the world. Rich Dad Poor. Series: Rich Dad · Author: Kiyosaki, Robert T. · Binding: Paperback · Page Count: · Publish Date: April 03, · ISBN · Language: English. Rich Dad Poor Dad is a book written by Robert T. Kiyosaki and Sharon Lechter. It advocates the importance of financial literacy (financial education). The author Robert Kiyosaki gives his point of view of how he escaped from the trap of working harder, anly to end up working harder. The rich dad implied a.

How To Buy A House When Credit Is Bad

You can still buy a home even with bad credit. Even with a credit score of , you can qualify for a mortgage with an FHA loan. Getting a mortgage with bad credit is possible, but it can be harder. Lenders will look at the credit score of people who apply for a mortgage. How to Buy a House With No Money Down and Bad Credit ; – Poor; – Fair; – Good ; Put at least 10% down with a score below Bad credit may not keep you from getting a mortgage, but it increases the costs of buying a home. Still, there are times when you might opt to buy a home even. Buying a House with Bad Credit · Take Steps to Improve your Credit. Regardless of your credit history, it is important to reduce debtand improve your credit. Buying a house with bad credit or low credit score can be challenging, but it's not impossible. Buying a house requires having money for a down payment, a solid. the worst time for you to buy a house. Interest rates are A bad car loan (installment loan) really hurts your credit. The only. Here are a few of the most common bad credit loan examples for homeowners, along with how long you'll need to wait to buy another home. Mortgage Write Off. Also. How to Buy a Home in Utah with Bad Credit · Apply an FHA Home Loan · Consider a Co-Signer · Make a Larger Down Payment · Accept a Higher Interest Rate · Improve Your. You can still buy a home even with bad credit. Even with a credit score of , you can qualify for a mortgage with an FHA loan. Getting a mortgage with bad credit is possible, but it can be harder. Lenders will look at the credit score of people who apply for a mortgage. How to Buy a House With No Money Down and Bad Credit ; – Poor; – Fair; – Good ; Put at least 10% down with a score below Bad credit may not keep you from getting a mortgage, but it increases the costs of buying a home. Still, there are times when you might opt to buy a home even. Buying a House with Bad Credit · Take Steps to Improve your Credit. Regardless of your credit history, it is important to reduce debtand improve your credit. Buying a house with bad credit or low credit score can be challenging, but it's not impossible. Buying a house requires having money for a down payment, a solid. the worst time for you to buy a house. Interest rates are A bad car loan (installment loan) really hurts your credit. The only. Here are a few of the most common bad credit loan examples for homeowners, along with how long you'll need to wait to buy another home. Mortgage Write Off. Also. How to Buy a Home in Utah with Bad Credit · Apply an FHA Home Loan · Consider a Co-Signer · Make a Larger Down Payment · Accept a Higher Interest Rate · Improve Your.

Buying a multi-family property using an FHA loan and a % down payment is possible, provided you occupy one unit. But there are some conditions. You can still buy a home with poor credit after you sell your current one, however, using a mortgage may not be possible. This all depends on how bad your. Bad credit can make buying a house challenging and expensive. However, in certain situations, it is possible to purchase a home with a bad credit score. Following these four tips can put you in a great position to get a home mortgage loan, even if your credit is poor. Remember, you're not the only one with bad. 5 Ways to Buy a House in Florida with Bad Credit. poor credit. Are you trying to buy a house in Florida but worried about your bad credit? Don't worry –. How to Get a Mortgage with Poor or Bad Credit · Check Your Credit Score. First things first: if you want to improve your credit score, you need to know what it. Poor: and lower. Falling into the “Poor” range means bad credit risks. Banks refuse mortgages for Americans with a poor FICO score. Can I Buy a House With Bad Credit? Good news! Homeownership is still possible with bad credit. While your credit score is important, lenders also look at your. Though it's difficult to get a mortgage with bad credit, it's not impossible. In fact, some mortgage types specifically cater to borrowers with less-than-ideal. Explain your credit situation. Sit down with your Realtor and draft a thorough letter explaining your credit situation. If you have poor credit, your lender may. How to boost your chances of being approved for a bad credit home loan. Fortunately, even if you have a low income, a poor credit score or negative marks in. Every day, in every corner of the country, there are people attempting to buy a house with poor, and sometimes, bad credit history. And like all. Utah Bad Credit Mortgage Loan Poor credit can limit home buying options, but it does not disqualify you from home ownership. Having poor credit can make the. How to Get a Mortgage with Poor or Bad Credit · Check Your Credit Score. First things first: if you want to improve your credit score, you need to know what it. The biggest thing you should know if you have bad credit but are applying for a mortgage anyway is this: it's going to cost you. Better credit means better. Can I Buy a House With Bad Credit? Good news! Homeownership is still possible with bad credit. While your credit score is important, lenders also look at your. What is Considered a Bad Credit Score? FICO scores range between and , and scores between are considered poor. FICO scores are broken down into. Following these four tips can put you in a great position to get a home mortgage loan, even if your credit is poor. Remember, you're not the only one with bad. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. Getting a mortgage with bad credit isn't easy, but it is possible to improve your credit score. See our guide on mortgages & bad credit.

What Is The Current Stock Market At

Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, A stock market site by Business Insider with real-time data, custom charts and breaking news. Get the latest on stocks, commodities, currencies, funds. Find the latest stock market news from every corner of the globe at gsrkro.site, your online source for breaking international market and finance news. Index breadth, or the percentage of stocks trading above long-term averages, is improving but appears to have stalled near current levels. Another headwind. Nearly everything on Wall Street is tumbling as fear of a slowing US economy grows and sets off another sell-off for financial markets around the world. Get the latest stock market news and analysis from the floor of the New York Stock Exchange. Bookmark our "quick links" for free calendars featuring. CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information. The IPC meets regularly to talk about the markets, the economy and the current environment, propose new policies and review existing guidance. U.S. Market Data ; NASDAQ Composite Index, 17,, , % ; S&P Index, 5,, , %. Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, A stock market site by Business Insider with real-time data, custom charts and breaking news. Get the latest on stocks, commodities, currencies, funds. Find the latest stock market news from every corner of the globe at gsrkro.site, your online source for breaking international market and finance news. Index breadth, or the percentage of stocks trading above long-term averages, is improving but appears to have stalled near current levels. Another headwind. Nearly everything on Wall Street is tumbling as fear of a slowing US economy grows and sets off another sell-off for financial markets around the world. Get the latest stock market news and analysis from the floor of the New York Stock Exchange. Bookmark our "quick links" for free calendars featuring. CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information. The IPC meets regularly to talk about the markets, the economy and the current environment, propose new policies and review existing guidance. U.S. Market Data ; NASDAQ Composite Index, 17,, , % ; S&P Index, 5,, , %.

Updated world stock indexes. Get an overview of major world indexes, current values and stock market data. Weekly market stats ; NASDAQ, 17,, % ; MSCI EAFE*, 2,, % ; yr Treasury Yield, %, % ; Oil ($/bbl), $, %. Stocks ; NVDA NVIDIA Corporation. ; INTC Intel Corporation. ; NU Nu Holdings Ltd. ; INND InnerScope Hearing Technologies, Inc. ; NIO NIO. What time does the stock market open? The NYSE and NASDAQ are open Monday-Friday a.m. to p.m. Eastern Time. There are 9 trading holidays when markets. Up to date market data and stock market news is available online. View US market headlines and market charts. Get the latest economy news, markets in our. Check out the best stock market forecasts and trading ideas: USA. Live stock quotes, latest news, earnings calendar, and much more. STOCK MARKET TODAY Dow Jones futures will open Sunday evening, along with S&P futures and Nasdaq futures. The stock market rally showed mixed action last. Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more. Find the latest stock market news from every corner of the globe at gsrkro.site, your online source for breaking international market and finance news. Stock Spotlight ; Most Actives · NVIDIA CORP. $ ; Top Gainers · INTEL CORP. $ ; Top Losers · SUPER MICRO COMPUTER INC. $ At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. S&P 5, (%) ; Intel. (%). AMZN · Amazon ; gsrkro.site (%). DOW · Dow Inc ; 3M. (%). AXP. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. U.S. & Americas Stock Indexes ; Total Stock Market · Total Stock Market. , , , Discover the U.S. markets today with Fox Business. See the trending stocks in the USA stock market and today's stock market results. The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. Breaking news and in-depth coverage from the global business and financial markets. The latest corporate earnings reports from the stock market and insights. Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today. In-. Realtime Prices for Dow Jones Stocks ; American Express, %. ; Amgen, %. A Complete Dow Jones Industrial Average overview by Barron's. View stock market news, stock market data and trading information current price and.

Investment Tutorial

Stock funds are another way to buy stocks. These are a type of mutual fund that invests primarily in stocks. Stock funds are offered by investment companies and. LESSON 4: FINDING STOCKS TO INVEST IN LESSON 6: THE INVESTMENT THESIS. The first step is learning to distinguish different types of investments and what rung each occupies on the risk ladder. Some examples of investments are stocks, bonds, mutual funds, and annuities. Investors can purchase these vehicles through investment accounts such as IRAs, Step 1: Set Clear Investment Goals · Step 2: Determine How Much You Can Afford To Invest · Step 3: Determine Your Risk Tolerance and Investing Style · Step 4. shares - you buy a stake in a company · cash – the savings you put in a bank or building society account · property – you invest in a physical building, whether. Do you have questions about investing? Here are Charles Schwab's frequently asked questions about how to invest. Diversification can be summed up with the familiar phrase: "Don't put all your eggs in one basket." Including different types of investments in your portfolio. Tutorials · THE BASICS - Your STYLE, Study History, Investing Mistakes, INVESTING GENERALIST, UNDERSTAND · Markets - Change, Value Investing, Stock Prices. Stock funds are another way to buy stocks. These are a type of mutual fund that invests primarily in stocks. Stock funds are offered by investment companies and. LESSON 4: FINDING STOCKS TO INVEST IN LESSON 6: THE INVESTMENT THESIS. The first step is learning to distinguish different types of investments and what rung each occupies on the risk ladder. Some examples of investments are stocks, bonds, mutual funds, and annuities. Investors can purchase these vehicles through investment accounts such as IRAs, Step 1: Set Clear Investment Goals · Step 2: Determine How Much You Can Afford To Invest · Step 3: Determine Your Risk Tolerance and Investing Style · Step 4. shares - you buy a stake in a company · cash – the savings you put in a bank or building society account · property – you invest in a physical building, whether. Do you have questions about investing? Here are Charles Schwab's frequently asked questions about how to invest. Diversification can be summed up with the familiar phrase: "Don't put all your eggs in one basket." Including different types of investments in your portfolio. Tutorials · THE BASICS - Your STYLE, Study History, Investing Mistakes, INVESTING GENERALIST, UNDERSTAND · Markets - Change, Value Investing, Stock Prices.

A mutual fund is a managed portfolio of investments that investors can purchase shares of. Mutual fund managers pools money from many investors. You just need to know a few basics, form a plan, and be ready to stick to it. Your investment professional should understand your invest- ment goals. Lesson plans · Teaching consumer and financial literacy · Student life and money They'll help you find investments that fit your risk tolerance and investment. This MoneySavingExpert guide shares the 10 things you need to know about investing, including how to invest and whether it's the right option for you. 1. Set investment goals. · 2. Know your investment time frame. · 3. Be patient. · 4. Test the waters. · 5. Explore investing through your company's retirement plan. The first step is learning to distinguish different types of investments and what rung each occupies on the risk ladder. basics about investing as early as possible in life. It's also important to think about your personal investment goals – the reason for your investment. An investment goal is just a dream until you have a plan to reach it. Start by understanding the basics of risk and return. Learn all the Basics of the Stock Market, through comprehensive, interesting and fun lectures We also discuss the investment strategies used by some of the. Your investment plan starts with a few key questions: Where are you now? And Before you can save or invest, you probably have to cover the basics: food. You can think of a brokerage account as your standard-issue investment account. Here are the basics: Pros—Flexibility. Anyone age 18 or older can open one.1 You. Investing involves putting your money to work through the buying and holding of investment products with the expectation of growing your money. Investing Basics · Advanced Investing · Market & Investing Insights. Product The Chief Investment Office (CIO) develops the investment strategies for. Investing basics. Advance slider to the left Tax laws and regulations are complex and subject to change, which can materially impact investment results. An ideal strategy for not only beginners but all levels of investors, ETFs have no minimum investment requirements and provide a one-stop shop for investing in. Learn the basics of investing, how you can start, and guiding principles that can help you along the way. Planning and Investments · Invest with our advisors · J.P. Morgan online investing · Investment Tools & Resources · Retirement Planning · Education Planning · Wealth. BLK® Basics. Investing can be a great Know what you're getting into before you invest your money, whether it's in stocks, bonds or an investment fund. Sometimes people refer to these options as "investment vehicles," which is just another way of saying "a way to invest." Each of these vehicles has positives. Smart investing starts with a solid grasp of the basics. Understand the math. What are compound interest and dollar cost averaging? Increase your financial.

Best Free Hr Software For Small Business

Grove HR - is a free HR platform for small and medium-sized businesses. The platform provides management of the entire employee lifecycle, starting with hiring. As one of the most fully featured free payroll programs for small businesses, Payroll4Free is our top free payroll software recommendation. Deel is a powerful HR software platform that's perfect for small businesses on a budget. In fact, its HR features are completely free for businesses with fewer. For example, BambooHR, a cloud-based human resource software, provides small businesses with a range of HRIS (human resource information system) tools. This. Sentrifugo Open source HRMS Sentrifugo is the best HR software for small & medium enterprises. ADOPT. ADAPT. ADVANCE. FOR FREE! Sentrifugo is a FREE and. Best HR Software for Small Businesses · 1. GoCo · 2. Gusto · 3. Justworks · 4. gsrkro.site · 5. When I Work · 6. Zoho People · 7. Sage HR · 8. ADP TotalSource. WebHR is an all-in-one HR software that includes core HR, payroll, recruitment, performance, and time & attendance modules. It's available in 30 languages. Top HR Software Solutions for Small Businesses: · Gusto - a popular choice among small businesses for its comprehensive suite of HR features. BambooHR knows small businesses. Set your people free to do great work for your SMB. Some of our amazing customers. Featured customer second genome logo. Grove HR - is a free HR platform for small and medium-sized businesses. The platform provides management of the entire employee lifecycle, starting with hiring. As one of the most fully featured free payroll programs for small businesses, Payroll4Free is our top free payroll software recommendation. Deel is a powerful HR software platform that's perfect for small businesses on a budget. In fact, its HR features are completely free for businesses with fewer. For example, BambooHR, a cloud-based human resource software, provides small businesses with a range of HRIS (human resource information system) tools. This. Sentrifugo Open source HRMS Sentrifugo is the best HR software for small & medium enterprises. ADOPT. ADAPT. ADVANCE. FOR FREE! Sentrifugo is a FREE and. Best HR Software for Small Businesses · 1. GoCo · 2. Gusto · 3. Justworks · 4. gsrkro.site · 5. When I Work · 6. Zoho People · 7. Sage HR · 8. ADP TotalSource. WebHR is an all-in-one HR software that includes core HR, payroll, recruitment, performance, and time & attendance modules. It's available in 30 languages. Top HR Software Solutions for Small Businesses: · Gusto - a popular choice among small businesses for its comprehensive suite of HR features. BambooHR knows small businesses. Set your people free to do great work for your SMB. Some of our amazing customers. Featured customer second genome logo.

Cangaroo HR is a favorite among small organizations that love the free version's simplicity and easy access from virtually any device. In addition, Cangaroo HR. Manage your employees and automate functions of HR with Connect & Simplify, a cloud-based human resource management software. Request a free consultation. Happy HR is the best HR software for small businesses. With our HR system, you will be able to manage your employees more efficiently. Book a demo today! HR software not only caters to large businesses with a robust HR department, but also to small businesses with no HR employees at all. In fact, the most common. HR Software can help small business owners and HR professionals to work seamlessly, and let them focus on scaling the business. Expand your team with the HR tools you need to make hiring and onboarding easy. Employee onboarding in Justworks is simple, automated, and online. From entering. Does anyone have any recommendations for the best ones, if any? I got webHr but really not a fan of it. Also, does anyone have any tips on where. Run payroll in minutes, sync it with your HR records, and get seamless integration with Xero, QuickBooks and Xledger. What's more, employees can submit expenses. Best SharePoint HR Software for Small Businesses and Startups · Value for money Simple and Intuitive · Easy to Integrate Comprehensive solution · Empower HR. Late to the conversation but HR Toolbox has a free tier. Best HR Software for Small Business · Best HR Onboarding Software · Best. Human Resources software for Small Businesses: Key insights from reviewers and vendors · Rippling · Justworks · BambooHR · Workable · Insperity · Deel · HR Hero. Give your HR team the tools they need to streamline administrative tasks, support employees, and make informed decisions with the OrangeHRM free and open. Connecteam offers free HR software for small businesses that allows job scheduling, quick task management, survey form creation, and other popular features. GoCo is an easy-to-use software that starts at $5 per employee per month for premium HR features. You can also customize your plan with additional features like. A completely free HR software for businesses with 1–9 employees saves time, cuts costs, and streamlines human resources. Track time-off, manage absences. BambooHR is a very famous HR software. this software is suitable, for small businesses or startups. BambooHR has features like people's data analytics. 11 Best Small Business HR Software in [TOP SELECTIVE ONLY] · #1) Paychex · #2) BambooHR · #3) ADP · #4) Rippling · #5) Gusto · #6) Paylocity · #7) OnPay · #8) GoCo. HR software for small businesses (SMES) helps to automate HR processes, saving you time and money. Learn how PeopleHR can grow your business today. Manage your HR the easy way with Breathe's HR software for small businesses. Simplify HR admin, centralise employee data & streamline your HR processes.