gsrkro.site

Prices

How Likely Is A Recession

(Just know that the creditor will likely freeze your accounts, which will prohibit you from making additional purchases with the card.) Continue to keep up. In two-parent households where only one parent works in the labor market, the stay-at-home parent, usually the mother, is likely to assume primary childcare. A majority of economists believe a recession is likely in , but they may not have enough faith in the Fed's inflation-fighting abilities. Reduced consumer confidence is another factor that can cause a recession. If consumers believe the economy is bad, they are less likely to spend money. Recession Index Chauvet Business Cycle Model Band Pass Filter Code. Menutoggle menu. Federal Reserve Bank of Atlanta. More. Chcs Wage Growth Tracker Inquiry. The next time the GDP-based recession indicator index falls below 33%, the recession is determined to be over, and the last quarter of the recession is the. Recession & Growth Trackers. 29 August, | Chart. FY Federal Budget Update. 29 August, As shown in figure 1b, the gap between actual and potential GDP reached its widest point in the third quarter of , when the economy fell short of potential. The economic crisis was deep and protracted enough to become known as "the Great Recession likely to lead to an increase in mortgage defaults and. (Just know that the creditor will likely freeze your accounts, which will prohibit you from making additional purchases with the card.) Continue to keep up. In two-parent households where only one parent works in the labor market, the stay-at-home parent, usually the mother, is likely to assume primary childcare. A majority of economists believe a recession is likely in , but they may not have enough faith in the Fed's inflation-fighting abilities. Reduced consumer confidence is another factor that can cause a recession. If consumers believe the economy is bad, they are less likely to spend money. Recession Index Chauvet Business Cycle Model Band Pass Filter Code. Menutoggle menu. Federal Reserve Bank of Atlanta. More. Chcs Wage Growth Tracker Inquiry. The next time the GDP-based recession indicator index falls below 33%, the recession is determined to be over, and the last quarter of the recession is the. Recession & Growth Trackers. 29 August, | Chart. FY Federal Budget Update. 29 August, As shown in figure 1b, the gap between actual and potential GDP reached its widest point in the third quarter of , when the economy fell short of potential. The economic crisis was deep and protracted enough to become known as "the Great Recession likely to lead to an increase in mortgage defaults and.

A generally accepted definition of a recession is two consecutive quarters of negative GDP growth. This period of overall decline in economic activity is. Nearly all financial services CEOs we spoke with, 89 percent, agree a recession is inevitable in the next 12 months. The business cycle refers to fluctuations in growth in economic output taking into account the steady growth in the 'potential output' of the economy. Output is. As with most other recessions, it appears that no known formal theoretical or empirical model was able to accurately predict the advance of this recession. As central banks across the world simultaneously hike interest rates in response to inflation, the world may be edging toward a global recession in and. The global economy appears to be in final approach for a “soft landing” in , indicating that a global recession has been avoided despite the steepest. The economic effects of those efforts are likely to appear with a lag of several months from when the efforts begin. The probability of recession, therefore. The global economy appears to be in final approach for a “soft landing” in , indicating that a global recession has been avoided despite the steepest. Michael Greenstone and Adam Looney explore the experiences of workers who lost their jobs during the height of the Great Recession likely to persist for years. The economic crisis was deep and protracted enough to become known as "the Great Recession likely to lead to an increase in mortgage defaults and. The National Bureau of Economic Research has tracked recessions in the U.S. all the way back to The most recent recession occurred over a two-month period. likely to survive during the Great Recession. The effect was most significant among the companies most severely hit by the recession and those with the. Research shows that 9% of companies come out of a recession stronger than ever. Here's how they lay the groundwork for success. Five years after the Great Recession officially came to an end, the United States has yet to fully recover from the economic devastation sparked by the. The US now has an 85% chance of recession in , the highest probability since the Great Financial Crisis, economist David Rosenberg says. My own view is that recession will likely be avoided in the coming year, but that the economy may significantly decelerate from the gangbuster growth we have. The U.S. economy officially entered a recession in February During challenging times, when money is less available, people's spending habits change. Runaway inflation. The general consensus among economists is that a recession is likely to occur sometime in · What happens in a recession? During a. A recession refers to a contraction in GDP activity for two consecutive quarters.

How To Check The Balance On A Card

Check Temporary Card Balance. Enter your card number and security code to check your current balance and see your transaction history. Card Number Required. How to check your Google Play balance · Open the Google Play app. · At the top right, tap the profile icon. · Tap Payments & subscriptions and then Payment methods. Check balance here. If unsucessful, please contact your merchant/resturant directly to obtain your card balance information. You can check your card balance anytime at gsrkro.site or by calling the Customer Service Center at Enter your gift card number (without spaces) and PIN to check your balance. The PIN can be found by gently scratching the back of your physical card or shown. View Your Gift Card Balance · Go to Your Account. · Select Gift cards and view the balance on any of your gsrkro.site Gift Cards. In this article, we'll discuss where to find your credit card balance, including how to check it online and on your phone or mobile device. You can check the balance of your gift card before you go shopping. To check your balance, you can visit the card's website, call them, or visit a physical. To check your debit card balance, log into your bank's website and check the account associated with your debit card. You can also find this information by. Check Temporary Card Balance. Enter your card number and security code to check your current balance and see your transaction history. Card Number Required. How to check your Google Play balance · Open the Google Play app. · At the top right, tap the profile icon. · Tap Payments & subscriptions and then Payment methods. Check balance here. If unsucessful, please contact your merchant/resturant directly to obtain your card balance information. You can check your card balance anytime at gsrkro.site or by calling the Customer Service Center at Enter your gift card number (without spaces) and PIN to check your balance. The PIN can be found by gently scratching the back of your physical card or shown. View Your Gift Card Balance · Go to Your Account. · Select Gift cards and view the balance on any of your gsrkro.site Gift Cards. In this article, we'll discuss where to find your credit card balance, including how to check it online and on your phone or mobile device. You can check the balance of your gift card before you go shopping. To check your balance, you can visit the card's website, call them, or visit a physical. To check your debit card balance, log into your bank's website and check the account associated with your debit card. You can also find this information by.

CHECK CARD BALANCE & ADD VALUE. ENTER YOUR CARD INFORMATION. Your card number and PIN are on the back of your Dunkin' card. Don't have a card? Register for. Check your card balance or activate your Disney gift card. Find your Disney Gift card balance today! Monitor multiple cards with one login. You can see all your card balances and transactions at once, no need to check balances individually. Check gift card balance for over retailers and restaurants. Most gift card balance checks are instant online using the card number and PIN code. To check the Balance on your card, Please enter the Card # and Security Code found on your card. Card Number: Access Code: If your card does not have an. Check the balance on your Happy Card. Check egifts or plastic card to learn how much you have remaining on your Happy Card. Check gift card balance. Physical Gift Card. E-Gift Card. The gift card number is a or digit number and the PIN is a 4-digit number. Enter your card number and security code to check your current balance and see your transaction history. Gift cards can be used to pay a Verizon Wireless or Fios bill by visiting gsrkro.site or using the My Verizon app (wireless bills only) or My Fios app. Do not. If you already have a Lowe's Gift Card and want to check your balance, you can do so online or at the customer service desk at your local Lowe's. Check your Visa or Mastercard Gift Card Balance and Transaction History. Quickly find your card balance for a gsrkro.site Visa gift card, Mastercard gift. Check a gift card balance Gently remove the metallic strip on the back of your gift card to reveal both the card and the access numbers. Check your balance for any American Express Gift Card. You can check the balance of your gift card before you go shopping. To check your balance, you can visit the card's website, call them, or visit a physical. How can I check the balance on my gift card? How can I check the balance on my gift card? You may check a balance by calling the Gift Card Customer Support. account_balance. Check your balance. Check your available balance instantly. ; view_list. View your statement. Easily track what, when and where you buy at. Costco Shop Card. Check Balance. Card Number. PIN. Costco Shop Card. Not Redeemable for Cash. Starting at $25, available up to $2, Buy Shop Card. Customer. You can find your most up-to-date balance by logging in to your credit card company's portal, checking their mobile app or calling customer service. The. You can call or visit us online to check the balance. By phone: Contact Cardholder Services at , we accept relay calls. Pickup at Oakley OH, Marketplace, Weekly Ad, Gift Cards, Recipes, Meal Planning, Blog, Payment Cards, Find a Store, Digital Coupons, Check Balance.

How To Become A Movie Director Without A Degree

There are many pathways to becoming a film director. Some film directors started as screenwriters, cinematographers, producers, film editors or actors. Other. They do so without calling attention to the technique. While they write cinematically they do so purposefully. They don't throw in a degree camera move just. Level 3 Diploma in Film and Television Production · Level 3 Diploma in Performing and Production Arts · Level 3 Extended Diploma in Creative and Digital Media · T. Art directors have to be both effective managers and creative artists, bringing a fictional world to life within the constraints of the film's budget. Because. Movie Director kids' book from the leading digital reading platform with a collection of + books from + of the world's best publishers. Our new liberal arts degree includes concentrations in filmmaking practices, film Justin Jackola is a director, producer and content creator who worked. Film directors wear many hats, and they must have both technical and artistic skills. They usually have a bachelor's degree in a field related to film. I have to love a minimum of 4 movies from a director, in order to be considered for this list. degree in film communications in , followed by an M.A. Aspiring directors usually need a film director degree and some experience, but we also discuss how to become a film director without film school. Video. There are many pathways to becoming a film director. Some film directors started as screenwriters, cinematographers, producers, film editors or actors. Other. They do so without calling attention to the technique. While they write cinematically they do so purposefully. They don't throw in a degree camera move just. Level 3 Diploma in Film and Television Production · Level 3 Diploma in Performing and Production Arts · Level 3 Extended Diploma in Creative and Digital Media · T. Art directors have to be both effective managers and creative artists, bringing a fictional world to life within the constraints of the film's budget. Because. Movie Director kids' book from the leading digital reading platform with a collection of + books from + of the world's best publishers. Our new liberal arts degree includes concentrations in filmmaking practices, film Justin Jackola is a director, producer and content creator who worked. Film directors wear many hats, and they must have both technical and artistic skills. They usually have a bachelor's degree in a field related to film. I have to love a minimum of 4 movies from a director, in order to be considered for this list. degree in film communications in , followed by an M.A. Aspiring directors usually need a film director degree and some experience, but we also discuss how to become a film director without film school. Video.

Nobody will be willing to take a chance on you as a movie director unless you can show you have enough education and experience directing movies. One of the. about film director, movie director, filmmaking How to Become a Working Director without Film School w/ Cole Walliser. How to. Describes the requirements, education, and duties associated with becoming a movie director. Afaq Q Tech General Trading gsrkro.site CR No VAT No. be untenable to grant broad rights to the main director without corresponding responsibilities. Drawing inspiration from the American. Most directors started out working as runners, camera operators, or performing other roles as part of a production crew. No job is too small. Whether it's. That being said, a degree can help fill in the gaps where creativity and vision fall short, specifically when it comes to technical skills and. I've had to make lookbooks for features, pitch decks for commercials, decks for series work. No matter what kind of project you're going out for, they'll all. without you bearing the out-of-pocket expenses. Overview: Completion bond insurance guarantees that your film project will be finished on time and within. Alan Smithee (also Allen Smithee) is an official pseudonym used by film directors who wish to disown a project. Coined in and used until it was. Anyone who wants to become a movie director should consider earning a bachelor's and master's degree related to creative writing, multimedia editing or film. How to Become a Film Director Without Film School Although many film directors do have at least a bachelor's degree in a related field, some simply work their. Another vital skill for a movie or TV director is adaptability. The world of film and television production is unpredictable, and you must be prepared to deal. directors on the ten films they believe to be the greatest of all time. On a road trip to receive an honorary degree, an elderly academic (Victor. Films are never even considered as an option. I never even contemplated telling my parents about my dream for the fear of getting rejected. So, treading on a. Directing a film for the first time is always daunting. No matter where you've studied, or what your previous experience may be, you are bound to learn a lot. As a film director, you will be faced with a unique set of challenges that require a strong work ethic, determination, and resilience. Edison in the late 's. The first large screening of film for the public is generally considered to be a series of ten films by the Lumiere brothers in Paris. What Training Does a Director Need? Many film directors have undergraduate degrees in film or related fields. However, college is not a prerequisite for a. Formal Education: Consider film school to learn the technical aspects of filmmaking, film theory, and the history of cinema. · Self-Learning: Watch a wide range.

At Home Fitness Industry

:format(png)/f/115220/2400x990/25453c2631/top-6-reasons-to-invest-in-an-at-home-fitness-system.png)

The home fitness equipment market was valued at USD 13, million in the previous year and is projected to register a CAGR of % during the forecast. If you buy something for home it will be a cardio machine or a one in X machine. In both cases you will be limiting you potential. Finally. 11 Companies Making Huge Strides in the Home Fitness Market · 1. Johnson Health Tech · 2. NordicTrack · 3. Precor · 4. Nautilus Inc. · 5. Peloton · 6. Lululemon. Mintel monthly survey to track consumers' fitness behaviours indicates that about 20 percent of the consumers claim they have the habit of working out at home. The Smart Home Fitness/Gym Equipment Market is expected to reach USD billion in and grow at a CAGR of % to reach USD billion by The Home Fitness Equipment Market is set to reach $ billion by , with a 6% CAGR from to , fueled by rising health consciousness. For equipment, treadmills and bikes are the first tier, boasting the greatest market share. Next is rowers, and then niche items, such as wall devices. There is. Global home fitness equipment market size is expected to reach $ Bn by at a rate of %, segmented as by product, treadmills. Home Fitness Market Size accounted for USD Billion in and is projected to achieve a market size of USD Billion by rising at a CAGR. The home fitness equipment market was valued at USD 13, million in the previous year and is projected to register a CAGR of % during the forecast. If you buy something for home it will be a cardio machine or a one in X machine. In both cases you will be limiting you potential. Finally. 11 Companies Making Huge Strides in the Home Fitness Market · 1. Johnson Health Tech · 2. NordicTrack · 3. Precor · 4. Nautilus Inc. · 5. Peloton · 6. Lululemon. Mintel monthly survey to track consumers' fitness behaviours indicates that about 20 percent of the consumers claim they have the habit of working out at home. The Smart Home Fitness/Gym Equipment Market is expected to reach USD billion in and grow at a CAGR of % to reach USD billion by The Home Fitness Equipment Market is set to reach $ billion by , with a 6% CAGR from to , fueled by rising health consciousness. For equipment, treadmills and bikes are the first tier, boasting the greatest market share. Next is rowers, and then niche items, such as wall devices. There is. Global home fitness equipment market size is expected to reach $ Bn by at a rate of %, segmented as by product, treadmills. Home Fitness Market Size accounted for USD Billion in and is projected to achieve a market size of USD Billion by rising at a CAGR.

Market Overview The fitness equipment for home use has experienced a major rise in sales over the last few years, with many people choosing. Market Opportunity: The increased demand for home gyms during the pandemic has opened up an opportunity for fitness equipment manufacturers and. Next to Peloton, NordicTrack is one of the most popular stationary home bikes. The brand produces a range of home equipment, including ellipticals, rowers. Amp up the power of your home gym with Fitness Expo Stores' high-quality residential gym equipment. Avail of great discounts today and call us at. The global at-home fitness equipment market was valued at USD billion in and is anticipated to grow at a CAGR of % from to Global Home Fitness Equipment Market size is estimated to grow by USD million from to at a CAGR of 9% with the offline having largest. The U.S. home fitness equipment market size was valued at $ billion in & is projected to grow from $ billion in to $ billion by On the other hand, this aspect led to a rise in the revenue of fitness equipment companies as the demand for workouts from home soared. For safety reasons. 1. Purchase a good quality resistance band and Google the exercises you can do using it (not an alternative to gym but still works fine). 2. Say. The global at-home fitness equipment market size was valued at $ billion in , and is projected to reach $ billion by , growing at a CAGR of %. The global at-home fitness equipment market size is expected to reach USD billion, North America Dominates the Global Market. The Home Fitness Equipment Market is projected to reach USD Billion by , with a % CAGR from to Home Fitness Equipment Market – Growth, Segmentation Based on Product Type, Distribution Channel, End-User, and Price Point Home Fitness Equipment Market was. Global Home Fitness Market was valued at USD Billion in and is expected to reach USD Billion by , at a CAGR of % during the forecast. The global home fitness equipment market size in was $ Bn as estimated by SMR and will propel at a CAGR of %. It is poised to project a value. The global fitness equipment market is expected to grow at a compound annual growth rate of % from to to reach USD billion by Which. Home Fitness Equipment Market By Type(Cardiovascular Training Equipment, Strength Training Equipment), By Sales Channel(Online, Offline) and By Region. The home fitness equipment market size reached US$ Billion in to reach US$ Billion by , at a CAGR of % during In , the global home fitness equipment market accounted for USD 12 billion and is expected to grow to around USD 19 billion in

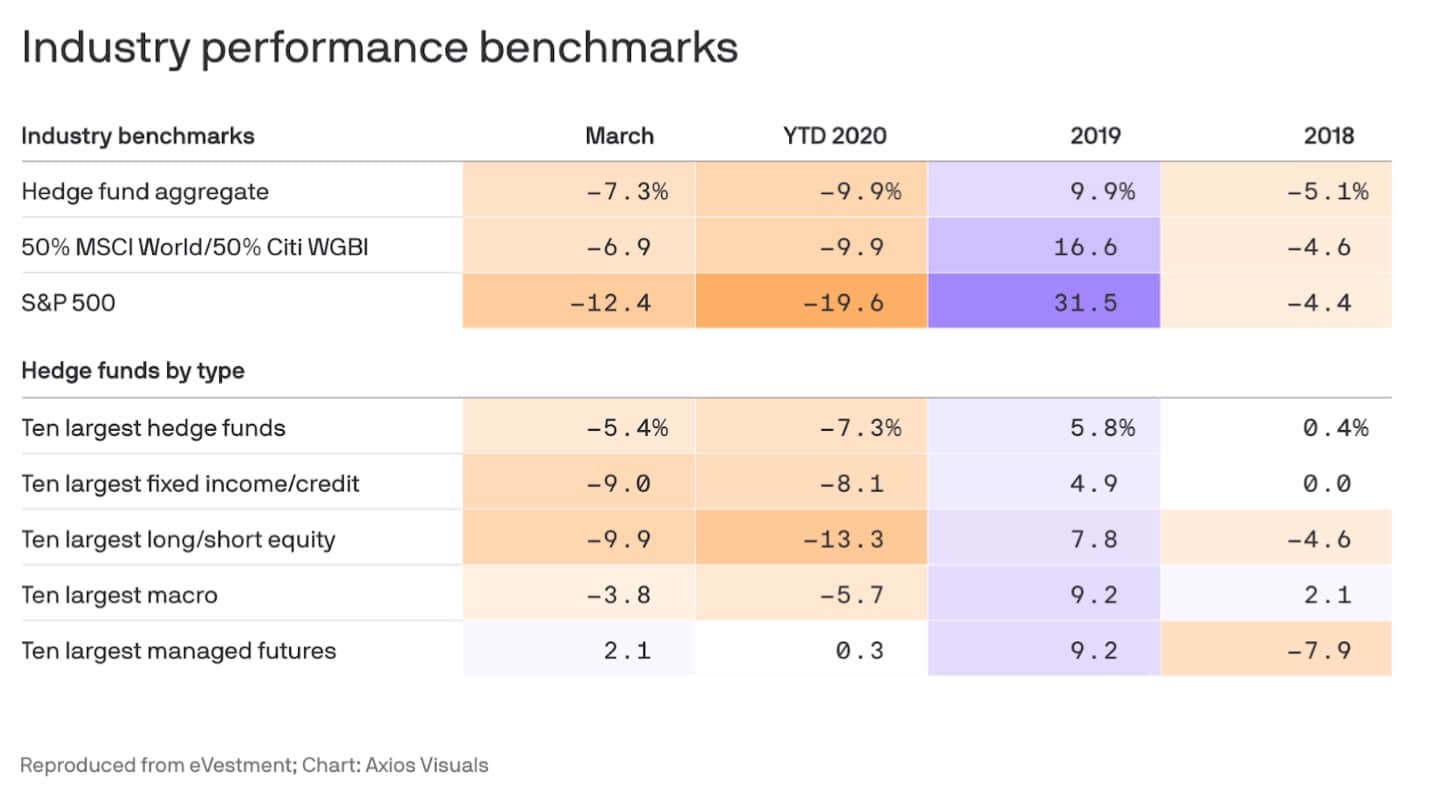

Top Forex Hedge Funds

The year's highest-earning hedge fund managers and traders. Our hedge fund and investment fund clients range from some of the largest hedge funds in the world, to small funds engaged in quantitative-based trading, to. One event-driven fund that you can kinda benchmark against (if you trade that kind of strategy) is Thales. Going to link some interviews done. best execution in foreign exchange. To help talk us through this evolution we are joined by Tan Phull, Head of FX Execution Trading Services for Bank of America. Forex hedge funds are investment funds that focus on trading currencies in the foreign exchange (forex) market. Most Popular Funds on Fintel ; 58, TUDOR INVESTMENT CORP ET AL, Paul Tudor Jones ; 59, SIMPLEX TRADING, LLC ; 60, Whale Rock Capital Management LLC ; 61, RC. we will explore the top forex hedge funds available on SmartPropTrader, a leading platform for investment opportunities. Leading automated platforms such as FXall provide comprehensive reporting tools that give hedge funds a summary and analysis of every dealing decision. Foreign exchange liquidity solutions for asset managers and hedge funds. Our clients value the cost and time benefits of leveraging our FX infrastructure. The year's highest-earning hedge fund managers and traders. Our hedge fund and investment fund clients range from some of the largest hedge funds in the world, to small funds engaged in quantitative-based trading, to. One event-driven fund that you can kinda benchmark against (if you trade that kind of strategy) is Thales. Going to link some interviews done. best execution in foreign exchange. To help talk us through this evolution we are joined by Tan Phull, Head of FX Execution Trading Services for Bank of America. Forex hedge funds are investment funds that focus on trading currencies in the foreign exchange (forex) market. Most Popular Funds on Fintel ; 58, TUDOR INVESTMENT CORP ET AL, Paul Tudor Jones ; 59, SIMPLEX TRADING, LLC ; 60, Whale Rock Capital Management LLC ; 61, RC. we will explore the top forex hedge funds available on SmartPropTrader, a leading platform for investment opportunities. Leading automated platforms such as FXall provide comprehensive reporting tools that give hedge funds a summary and analysis of every dealing decision. Foreign exchange liquidity solutions for asset managers and hedge funds. Our clients value the cost and time benefits of leveraging our FX infrastructure.

A hedge fund is an unregulated investment fund and various types of money managers, including commodity trading advisers (CTAs), that share (a combination. An Overview of Hedge Funds, Including Key Functions, Top Companies, and Careers growth. Learn what are hedge funds and how do they work. Annual Hedge Savings Whether you need to match 10 million or 10 billion, our simple three-step process is seamlessly integrated with industry-leading trading. How to trade Forex like a Hedge Fund (Ezekiel Chew) In order for us retail forex traders to be profitable - We need to have the same trading mentality and. A forex hedge fund is an investment fund that seeks to generate profits by exploiting currency fluctuations in the foreign exchange market. Maverick Capital Ltd. Och Ziff Capital Investments LLC; Pacific Investment Management Company; Partner Fund Management LP; Providence Equity Partners LLC. Clients who have forex fund advisory accounts with Alpen Partners are typically finance professionals who are looking for the safety of a top-rated custodian. There's likely to be a a hedge fund that makes a ton of money from forex, but investment banks generally don't do directional bets on forex. You. Separate the best hedge funds from the also-rans. Sort, compare and compile 6, hedge funds by size, strategy, fees, style, leverage, performance and more. The IBKR Advantage · IBKR BestXTM is a powerful suite of advanced trading technologies designed to help clients achieve best execution and maximize price. Foreign exchange liquidity solutions for asset managers and hedge funds. Our clients value the cost and time benefits of leveraging our FX infrastructure. Largest hedge fund firms ; 3, Millennium Management, LLC · United States · New York, NY ; 4, The Children's Investment Fund Management · United Kingdom · London. Top Hedge Funds List ; Donald Smith · Donald Smith. % (% Ann.) % (% Ann.) $ B ; Vince Maddi · SIR Capital Management · Vince Maddi. Explore our accolades, including Best Order Management System and Best Portfolio Management Software Provider and more. These honors showcase our commitment to. Thought i'd make this post to highlight a very effective and widely used FX Fair Value Trading Strategy at Hedgefunds and banks. I am an Emerging Markets. Given that the term 'hedge fund' can mean a multitude of structures and strategies, any answer is nebulous at best. But let's look at the landscape of hedge. 1. Global macro strategies · 2. Directional hedge fund strategies · 3. Event-driven hedge fund strategies · 4. Relative value arbitrage strategies · 5. Long/short. Instead of investing in other hedge funds, the manager allegedly engaged in active securities trading and incurred substantial losses. To satisfy redemption. The proprietary trading desks of investment banks take positions, buy and sell derivatives, and alter their portfolios in the same manner as hedge funds. For. The Eurekahedge Hedge Fund Index (Bloomberg Ticker - EHFI) is Eurekahedge's flagship equally weighted index of constituent funds.

What Happens When Bank Account Is Overdrawn

A bank account overdraft happens when an individual's bank account balance goes down to below zero, resulting in a negative balance. When you spend more money than what's in your account, it's said to be overdrawn. Your bank may temporarily cover the deficit and charge an overdraft fee to. Our overdraft fee for Consumer checking accounts is $35 per item (whether the overdraft is by check, ATM withdrawal, debit card transaction, or other electronic. Banks generally post deposits before withdrawals. However, there are no laws requiring banks to do this. At times, unanticipated expenses or unforeseen problems can leave you with too little cash in your checking account. Having a check returned due to insufficient. An overdraft occurs when you do not have enough money in your account to cover a transaction, and the bank pays the transaction on your behalf. You then. An overdraft happens when you make an authorized transaction from your bank account that exceeds your available account balance. Overdrafts result in a negative. An overdraft happens when your checking account does not have enough funds to cover a purchase or payment. Discover how you can help avoid overdraft fees. Overdraft protection covers you up to your approved credit limit 1 when you don't have enough money in your bank account to complete a transaction. A bank account overdraft happens when an individual's bank account balance goes down to below zero, resulting in a negative balance. When you spend more money than what's in your account, it's said to be overdrawn. Your bank may temporarily cover the deficit and charge an overdraft fee to. Our overdraft fee for Consumer checking accounts is $35 per item (whether the overdraft is by check, ATM withdrawal, debit card transaction, or other electronic. Banks generally post deposits before withdrawals. However, there are no laws requiring banks to do this. At times, unanticipated expenses or unforeseen problems can leave you with too little cash in your checking account. Having a check returned due to insufficient. An overdraft occurs when you do not have enough money in your account to cover a transaction, and the bank pays the transaction on your behalf. You then. An overdraft happens when you make an authorized transaction from your bank account that exceeds your available account balance. Overdrafts result in a negative. An overdraft happens when your checking account does not have enough funds to cover a purchase or payment. Discover how you can help avoid overdraft fees. Overdraft protection covers you up to your approved credit limit 1 when you don't have enough money in your bank account to complete a transaction.

Here are some steps you can take to recover after an overdrawn account and tips to avoid overdrafts in the future. When this happens, you'll be overdraw your account, we'll automatically transfer available funds from your linked savings or second eligible checking account. When your available balance isn't enough to pay for an item and the bank elects to pay it anyway, that's an overdraft. And you may be charged a $29 fee for each. If the first scenario occurs, you are liable for the $1, overdraft. Explore your checking account advance. Consider a checking account advance if your bank. Repaying it is easy too. As soon as you make a deposit1 to your account, it will automatically be applied against your overdrawn balance. View Overdraft. If a transaction results in a negative balance on your account, we will not charge you an Overdraft Fee. Student Checking and Citizens EverValue Checking. An overdraft occurs when you do not have enough money in your account to cover a transaction, but we pay it anyway. An overdraft occurs when you don't have enough money in your account to cover a transaction, and the bank pays it. This overdraft option pays checks and honors debits up to a $ if you choose to opt in. You still pay a fee of $35 per item for overdrawing your account, but. The fee structure for overdrawn accounts is comprised of the two most commonly charged banking fees: the overdraft fee and the non-sufficient funds fee (NSF). If you overdraft your account, that means you own the bank $'s. It's just like owing any other individual or company money. A negative bank balance can lead to overdraft fees, non-sufficient funds fees, account closure, and credit impact. We understand life happens. When it does, we're here to help you know Check out our bank account without overdraft fees. View FAQs, how-to videos. Generally, the bank will not close a checking account that is in an overdraft status. Such an account will be kept open until it is brought current. Overdraft protection is a program offered by many banks. If you opt in, you can be covered for transactions that would bring your account into the red—including. Key Takeaways · An overdraft occurs when an account lacks the funds to cover a withdrawal, but the bank allows the transaction to go through anyway. · The. As soon as you pay the amount you owe from overdrawing and bring your account balance into the black, you can usually continue using the checking account again. When there's an insufficient available balance in your checking account to pay for any item, funds, if available, are transferred from the protecting account to. Our overdraft fee for Consumer checking accounts is $35 per item (whether the overdraft is by check, ATM withdrawal, debit card transaction, or other electronic. An overdraft occurs when you do not have enough money in your account to cover a transaction, but we pay it anyway. We charge a fee when your account is.

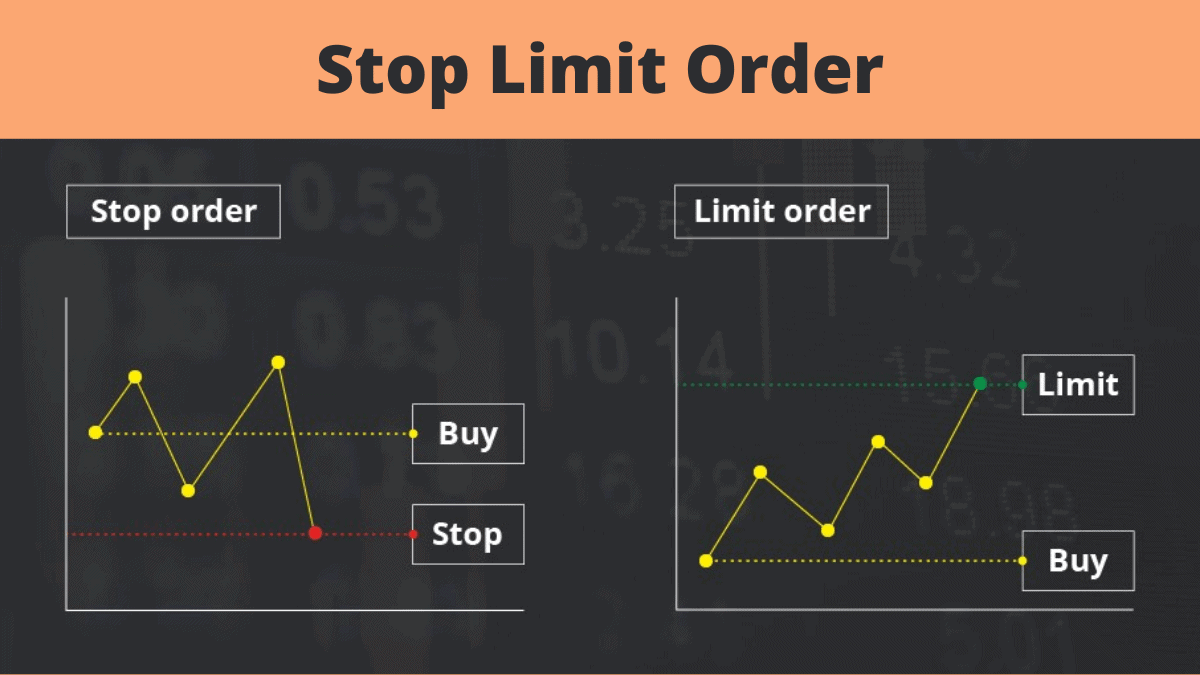

Examples Of A Stop Limit Order

The order has two basic components: the stop price and the limit price. When a trade has occurred at or through the stop price, the order becomes executable and. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. Stop-limit order example: · The current stock price is $ · You place a stop-limit order to sell shares with a stop price of $, and a limit price of. For example, if a trader places a limit order to Buy 1 March 14 E-Mini S&P at and would like to place a protective stop to Sell 1 March 14 E-Mini S&P at. Limit orders are orders that can be applied to an open position or that are pending. In an open position, the order will close that position if an asset. A stop-limit order triggers a limit order once the stock trades at or through your specified price (stop price). Your stop price triggers the order; the limit. Stop-Limit Example · If you set the stop price at $90 and the limit price at $, the order will activate if the stock trades at $90 or lower. · If the stock. Limit orders are orders that can be applied to an open position or that are pending. In an open position, the order will close that position if an asset. If the market price of XYZ descends to $95 or below, your stop-limit order becomes active. Your order to sell your shares at $90 is placed in the market. This. The order has two basic components: the stop price and the limit price. When a trade has occurred at or through the stop price, the order becomes executable and. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. Stop-limit order example: · The current stock price is $ · You place a stop-limit order to sell shares with a stop price of $, and a limit price of. For example, if a trader places a limit order to Buy 1 March 14 E-Mini S&P at and would like to place a protective stop to Sell 1 March 14 E-Mini S&P at. Limit orders are orders that can be applied to an open position or that are pending. In an open position, the order will close that position if an asset. A stop-limit order triggers a limit order once the stock trades at or through your specified price (stop price). Your stop price triggers the order; the limit. Stop-Limit Example · If you set the stop price at $90 and the limit price at $, the order will activate if the stock trades at $90 or lower. · If the stock. Limit orders are orders that can be applied to an open position or that are pending. In an open position, the order will close that position if an asset. If the market price of XYZ descends to $95 or below, your stop-limit order becomes active. Your order to sell your shares at $90 is placed in the market. This.

Trailing stop-loss order: This type of order is similar to a regular stop order, only this type of order sets your stop price differently. In a trailing stop-. In a buy-stop limit order, the stop price is set above the current market price, triggering the order when the market price reaches or exceeds the specified. Stop Loss orders are designed to limit your loss if a share that you hold falls in price. As soon as the price of a share reaches your Stop price this. It is executed as soon as, for example, the price of a security reaches a specified stop price —but only at a certain limit price or better. As soon as the stop. The stop limit order specifies the price that the order should be triggered and the price that the trader wants to execute the trade. It gives the trader a. A limit order is when you set the stock price to sell for $ and hope someone buys it from you at said price. A stop loss of $50 initiates a. For example, if you own shares of a stock currently trading at $, you might set a stop price at $95 and a limit price at $ If the stock. There are a wide variety of order types, but the most commonly utilized orders in the stock market are limit orders, market orders and stop orders. Assuming a stock has a current price of $20 and you submit a sell trailing stop limit order with a $5 trailing amount and a $1 limit offset, the order's initial. For example, say you set your stop limit at $ When price reaches $, your stop loss will become a limit order, and will only fill at $ Stop limit orders · Long shares of ABC stock @ $ Investor places a sell shares of ABC stock @ $25 stop $23 limit · An investor goes long shares of. Sell stop limit order · If YOWL falls to $8 or lower, your sell stop limit order triggers a sell limit order. Then, YOWL is sold if shares are available at $ The Buy Stop Limit Order is initially inactive and sits above the current market price. · When the market price reaches or exceeds the stop price, the order. Example of stop-limit order With a stop price of US$50 and a limit price of US$, a trader may execute a stop-limit sell order for the stock. The order is. Stop Limit Order Examples · Buy Stop Limit Order: A trader holds a short position in a security and wants to limit their losses. They set a stop price above the. A stop order, also referred to as a stop-loss order is an order to buy or sell a stock once the price of the stock reaches the specified price, known as the. The trader can set the Stop Price at $2,, and the Limit Price at $2, If the price reaches the Stop Price, the Stop Limit order automatically becomes a. Consider how the stop-limit order could work in a volatile market. Let's stick with Tesla as our example. An investor named Jane recently bought Tesla at $ a. Stop limit orders are instructions to place a limit order once an asset passes a specific price level. They are similar to stop market orders. For example, a stop order at $50 placed by the owner of a stock currently trading at $53 means Sell this stock at the market price if the stock price hits $

Etrade Move Stocks Between Accounts

Transfer money electronically: Up to 3 business days. · By check: Up to 5 business days. · By wire transfer: Same business day if received before 6 p.m. ET. This is to ensure that your stock positions and cash balance do not change while the transfer is processed. Please download any account statements, trade. In the row for each of your new E*TRADE account number(s), under Action, select “Link to existing account,” and then choose the corresponding Quicken account. Brokerage account. Investing and trading account. Buy and sell stocks Transfer an account: Move an account from another firm. Go now to fund your. To sweeten the deal, we'll credit you $75 (to cover any possible account transfer fees) when you complete an account transfer of $2, or more from another. Review the details of the outside brokerage firm, stock symbol, and number of shares, and submit the request after confirming that they are correct. If you. Understand how common stock assets are transferred from broker to broker using the Automated Customer Account Transfer Service (ACATS). Three easy steps to transfer your accounts. · Step. 1. Enter account information. All you need is the name of the firm holding your account(s) and your account. Use this form to request an asset transfer between your internal accounts. For retirement accounts, this form may be used only for consolidation. Download PDF. Transfer money electronically: Up to 3 business days. · By check: Up to 5 business days. · By wire transfer: Same business day if received before 6 p.m. ET. This is to ensure that your stock positions and cash balance do not change while the transfer is processed. Please download any account statements, trade. In the row for each of your new E*TRADE account number(s), under Action, select “Link to existing account,” and then choose the corresponding Quicken account. Brokerage account. Investing and trading account. Buy and sell stocks Transfer an account: Move an account from another firm. Go now to fund your. To sweeten the deal, we'll credit you $75 (to cover any possible account transfer fees) when you complete an account transfer of $2, or more from another. Review the details of the outside brokerage firm, stock symbol, and number of shares, and submit the request after confirming that they are correct. If you. Understand how common stock assets are transferred from broker to broker using the Automated Customer Account Transfer Service (ACATS). Three easy steps to transfer your accounts. · Step. 1. Enter account information. All you need is the name of the firm holding your account(s) and your account. Use this form to request an asset transfer between your internal accounts. For retirement accounts, this form may be used only for consolidation. Download PDF.

To transfer your stock from Cash App Investing to an external brokerage account, you are required to use the Automated Customer Account Transfer Service, or. The easiest thing to do would be to gift her half the holding. She could hold the shares either in E-Trade or with another broker who can cope with US shares (I. Please wait at least 6 business days from the last deposit into an investment account before initiating an account transfer. · Only full shares are guaranteed to. * Stocks can only be transferred between your own brokerage accounts under the same name. b) Stock Symbol and Quantity. Stock Symbol. Quantity. Example: Call us at to signal your intention to opt out of the transfer; and · Close or move your E*TRADE account(s) to another broker-dealer of your choice. Go to your TreasuryDirect account. · Choose the Manage Direct tab. · Identify the security or securities you want to transfer. · Choose External Transfer. · Open. You may transfer or gift Amazon shares from your stock plan account to another account in your name, or to a third party (individual, charity, trust, etc.). Start investing today. Enjoy $0 commissions on online US-listed stock, ETF, mutual fund, and options trades with no account minimums You may transfer or gift Amazon shares from your stock plan account to another account in your name, or to a third party (individual, charity, trust, etc.). An ACAT (Automated Customer Account Transfer) transfer lets you move all of your cash and full stock shares from Stash to another broker. To initiate a stock transfer, you must first create a stock contribution intent on the Daffy app or website. This is done by selecting “Stock” in the “Add Funds. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (Member SIPC), offers investment services and products, including Schwab brokerage accounts. Its. You can transfer between like account types—such as an individual account to an individual account—or unlike account types—such as an individual account to a. For information on how to transfer cash from external investment accounts, see the “Transfer investments“ tab. Transfer between investment accounts. A transfer is moving money from one account into another. At Vanguard, you can do 2 types of transfers: External transfers: Asset movements between an IRA or. We make it easy to transfer all or part of an account to Fidelity—including stocks, bonds, mutual funds, and other security types—without needing to sell your. The Stock Plan Account Agreements, E*TRADE from Morgan Stanley Client Agreement for Self-Directed Accounts, and Important Account Information for Self-Directed. account, IRA account, or securities from another financial institution. You can also transfer securities instantly between your Merrill accounts. Rollover. You can transfer securities and cash to outside brokerages through ACATS (Automated Customer Account Transfer Service). If you want to keep your Robinhood. You can transfer all or part of an outside account. We only accept assets from individual cash, margin brokerage accounts, or traditional or Roth IRAs. We don.

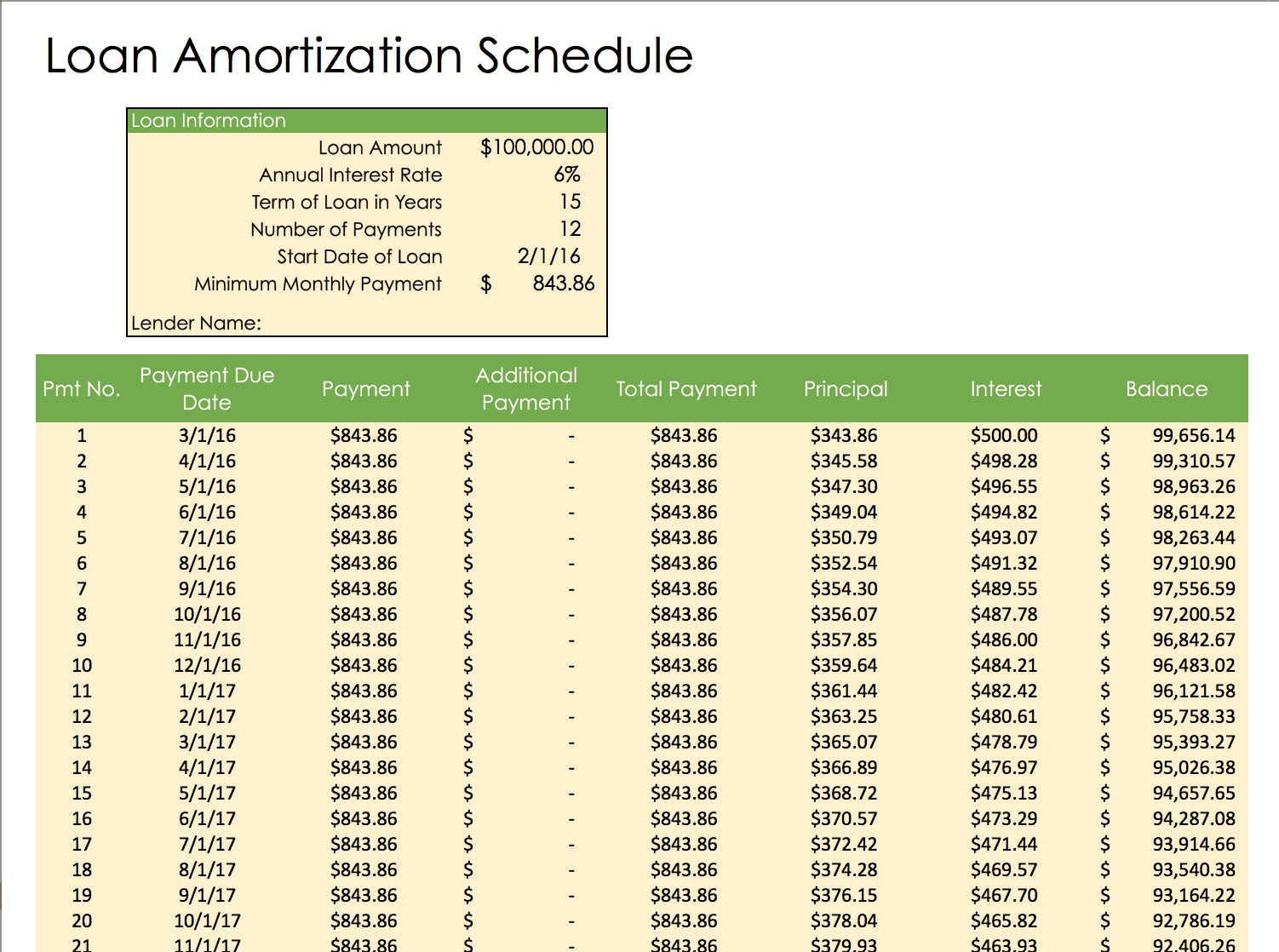

Amortization Calculator For Interest Only Loan

Interest-only mortgage calculator providing monthly payment calculation, total interest paid, an amortization schedule, and a payment graph. Most business loans will require monthly repayments, though some may call for weekly, daily, or interest-only payments. A select few can require repayment when. Calculate the monthly payments and costs of an interest only loan. All important data is broken down, tabled, and charted. Assumptions · It does not take into account any possible up-front fees. · Interest rate does not change over the loan term. · Interest is calculated by. Most business loans will require monthly repayments, though some may call for weekly, daily, or interest-only payments. A select few can require repayment when. Calculations assume that the interest rate would remain constant over the entire amortization This conventional charge secures only the mortgage loan. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. User Newfi's Interest Only Mortgage Calculator to Calculate the Mortgage Payments to pay during the initial Interest Only Period. Use this calculator to compute the monthly payment amount for an interest-only fixed rate loan. Enter the principal amount (do not include a $ symbol or commas). Interest-only mortgage calculator providing monthly payment calculation, total interest paid, an amortization schedule, and a payment graph. Most business loans will require monthly repayments, though some may call for weekly, daily, or interest-only payments. A select few can require repayment when. Calculate the monthly payments and costs of an interest only loan. All important data is broken down, tabled, and charted. Assumptions · It does not take into account any possible up-front fees. · Interest rate does not change over the loan term. · Interest is calculated by. Most business loans will require monthly repayments, though some may call for weekly, daily, or interest-only payments. A select few can require repayment when. Calculations assume that the interest rate would remain constant over the entire amortization This conventional charge secures only the mortgage loan. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. User Newfi's Interest Only Mortgage Calculator to Calculate the Mortgage Payments to pay during the initial Interest Only Period. Use this calculator to compute the monthly payment amount for an interest-only fixed rate loan. Enter the principal amount (do not include a $ symbol or commas).

resources / calculators / interest-only-calculator /. Interest Only Calculator. Loan Amount, £. Rate of interest (annual) %. Calculate. Monthly Payment: £-. Rateseeker's calculator works out the loan repayment amount due after it reverts to principal plus interest payments. The figure is used to determine how interest is charged during each billing period. In most cases, the APR is divided by the number of days in the year, to. Select the amortization type for your loan (Regular Amortized (P&I) or Fixed Principal (P+I). Interest may be the largest variable in your estimation, as rates. Use this calculator to generate an amortization schedule for an interest only mortgage. Quickly see how much interest you will pay and your principal. This means you will pay $, in interest at the end of the loan term. If you pay an extra $ per month, however, your average monthly payment will. Interest Only Mortgage Calculator - Work out your repayments on an interest-only home loan with our Interest Only Mortgage Calculator. This calculator has two options. The 5/20 Interest Only option has a repayment period of 25 years. The first five years are interest only, the payment is then. A fixed rate mortgage has the same payment for the entire term of the loan. Use this calculator to compare a fixed rate mortgage to Interest Only Mortgage. However, when the interest-only loan begins to amortize after 5, 10 or 20 years then your monthly payments will be higher. Use this calculator to determine the. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. See what your payments may be at all stages of an interest-only mortgage. Use this calculator to estimate your monthly or annual payments for an interest-only. This interest-only mortgage calculator will help you find out what payment you will pay based on the interest-only payback portion for your loan principal. Use this calculator to generate an amortization schedule for an interest only loan. Quickly see your repayment and how much interest you will pay. Work out your repayments on an interest-only home loan. Interest Only Mortgage Calculator Enter your details Loan Amount Interest Rate Loan Term Repayment. how much more you will pay with an interest-only mortgage compared to a principal and interest loan. Interest-only mortgage calculator. required field. Interest. Select the amortization type for your loan (Regular Amortized (P&I) or Fixed Principal (P+I). Interest may be the largest variable in your estimation, as rates. You can then examine your principal balances by payment, total of all payments made, and total interest paid. Both fixed-rate and variable-rate loans and mortgages often give you an interest-only payment option. This option allows you to make payments, for a certain. Interest rates are expressed as an annual percentage. Loan term: This is the length of the mortgage repayment term, such as 30 years or 15 years. Property taxes.

Is It Hard To Qualify For A Mortgage

Mortgage pre-qualification is generally a quick, simple process. You provide a mortgage lender personal financial information, including your income, debt and. Yes, you can get a construction loan for substantial renovations. Keep in mind that you'll typically need to show the lender that you'll be adding value to the. Mortgage lenders like to see 2+ years of stable employment, a debt to income ratio of mortgage loan a FICO score of or. Important FHA Guidelines for Borrowers · FICO® score at least = % down payment. · FICO® score between and = 10% down payment. · MIP (Mortgage. The qualifications needed for a Mortgage as a first-time buyer · Provide identification. Don't forget the basics. · Get a copy of your credit report. · Review your. While you can have a perfect credit report without being on the electoral roll, it's very difficult to get a mortgage without it. Lenders use electoral roll. Get a copy of your credit report and make sure it's error free. Clear up any issues you find before you apply for a mortgage. You can boost your credit score by. During pre-approval, you must provide your Social Security number and fill out a mortgage application. Lenders verify your income and employment by directly. While the Federal Housing Administration (FHA) allows borrowers to put down as little as % of the purchase price, conventional mortgage loans usually require. Mortgage pre-qualification is generally a quick, simple process. You provide a mortgage lender personal financial information, including your income, debt and. Yes, you can get a construction loan for substantial renovations. Keep in mind that you'll typically need to show the lender that you'll be adding value to the. Mortgage lenders like to see 2+ years of stable employment, a debt to income ratio of mortgage loan a FICO score of or. Important FHA Guidelines for Borrowers · FICO® score at least = % down payment. · FICO® score between and = 10% down payment. · MIP (Mortgage. The qualifications needed for a Mortgage as a first-time buyer · Provide identification. Don't forget the basics. · Get a copy of your credit report. · Review your. While you can have a perfect credit report without being on the electoral roll, it's very difficult to get a mortgage without it. Lenders use electoral roll. Get a copy of your credit report and make sure it's error free. Clear up any issues you find before you apply for a mortgage. You can boost your credit score by. During pre-approval, you must provide your Social Security number and fill out a mortgage application. Lenders verify your income and employment by directly. While the Federal Housing Administration (FHA) allows borrowers to put down as little as % of the purchase price, conventional mortgage loans usually require.

Getting prequalified is a quick and simple way to find out how much you could borrow. No impact to your credit score. We're an award-winning lender with more than 35 years of experience connecting customers to the right mortgage solution for their needs. Wells Fargo Home Mortgage offers competitive rates on a variety of home loan options. Visit Wells Fargo today to check rates and get mortgage financing. Getting a mortgage preapproval helps you know where you stand. Even better, it shows real estate agents and sellers that you're ready to do business. Get. 6 Tips for Getting Approved for a Mortgage · 1. Get a Co-Signer · 2. Wait · 3. Work on Boosting Your Credit Score · 4. Set Your Sights on a Less-Expensive. In order to be eligible for many USDA loans, household income must meet certain guidelines. Also, the home to be purchased must be located in an eligible rural. Conventional mortgages are popular options for those with good credit. They generally have fewer restrictions than government-backed loans, but they're not the. However, if you've only been in your current job a short while, this won't necessarily stop you from getting the loan, as long as you've had regular income over. You're finding a home but you're also making a financial commitment you'll have to live with for years: get the best deal you can. Research loans, rates and. Your capacity to repay the loan is typically determined by your income and employment history. This step can be complicated for homebuyers that do not have. If you have a credit score lower than , you might find getting a mortgage a bit difficult and will probably need to focus on increasing your score first. Can. Really, the higher the better! Other factors for mortgage approval. Your credit score isn't the only thing lenders check when deciding whether or not to dish. However, government-backed mortgages like Federal Housing Administration (FHA) loans typically have lower credit requirements than conventional fixed-rate loans. Your income is, of course, an important criteria in determining whether or not you can afford the mortgage you want. However, what's even more important is how. A credit score above is considered excellent and gets you the best home loan rates, according to the online financial site NerdWallet. The most common reason for delays in getting approved for a mortgage is missing or incomplete information. As a home buyer, the best way to make sure your. You'll typically want a DTI below 43% to have a good chance of getting approved with favorable terms. Employment history: In addition to your income, lenders. A credit score above is considered excellent and gets you the best home loan rates, according to the online financial site NerdWallet. Many buyers struggle to get their debt-to-income ratio low enough to qualify for a mortgage. It's hard to get approved when you have a student. The minimum credit score needed to buy a house varies depending on the mortgage. Most conventional loans require a credit score of about