gsrkro.site

News

Can I Buy Stock Through My Bank

Merrill can be especially beneficial for clients of Bank of America. can buy stocks through most online brokers commission-free. Frequently asked. Foreign investors can buy Samsung Electronics shares through a local securities firm or bank. Procedure Some securities firms have a minimum balance. After opening your account, connect it with your bank checking account to make deposits, which are then available for you to invest in. Trade TSLA, AMZN, AAPL, and more of your favorite stocks and ETFs 24 hours a Stocks & funds offered through Robinhood Financial. Other fees may. Trade stocks, ETFs, options, no-load mutual funds, money markets, and more. Simple, transparent pricing. $0 minimum to open account. $0 per online stock and ETF. If you want to buy and sell shares, our Smart Investor platform allows you to open an investment account, a stocks and shares ISA or a Self-Invested Personal. You can open an investment account online in just a few minutes and if you already have a Bank of America account most of your information will prefill. If. Before you can start purchasing stocks, you need to select a brokerage account to do it through. You can choose to go with a trading platform offered by a. $ per stock and ETF trades · Get free trades per year with a self-directed account enrolled in paperless document delivery and a U.S. Bank SmartlyTM. Merrill can be especially beneficial for clients of Bank of America. can buy stocks through most online brokers commission-free. Frequently asked. Foreign investors can buy Samsung Electronics shares through a local securities firm or bank. Procedure Some securities firms have a minimum balance. After opening your account, connect it with your bank checking account to make deposits, which are then available for you to invest in. Trade TSLA, AMZN, AAPL, and more of your favorite stocks and ETFs 24 hours a Stocks & funds offered through Robinhood Financial. Other fees may. Trade stocks, ETFs, options, no-load mutual funds, money markets, and more. Simple, transparent pricing. $0 minimum to open account. $0 per online stock and ETF. If you want to buy and sell shares, our Smart Investor platform allows you to open an investment account, a stocks and shares ISA or a Self-Invested Personal. You can open an investment account online in just a few minutes and if you already have a Bank of America account most of your information will prefill. If. Before you can start purchasing stocks, you need to select a brokerage account to do it through. You can choose to go with a trading platform offered by a. $ per stock and ETF trades · Get free trades per year with a self-directed account enrolled in paperless document delivery and a U.S. Bank SmartlyTM.

Start investing in stocks and TD ETFs in both Canadian and U.S. currency, with no minimums on this easy-to-use mobile app. Open an account. Step-by-step guide · 1. Select the account you want to trade in. · 2. Enter the trading symbol. · 3. Select Buy or Sell. · 4. Choose between Dollars and Shares. Diversification does not ensure a profit or protect against a loss. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them. When you invest in stocks through your bank's brokerage, you actually own those stocks. You're not just lending money to the bank. You have the freedom to invest in whatever you choose—stocks, bonds, mutual funds, and more—as you own all the assets in your brokerage account. WellsTrade® gives you the flexibility to trade stocks on your own with enhanced market research and extended trading hours. With Lloyds Bank Share Dealing you can start trading shares, funds, ETFs and more I'm comfortable choosing my own shares, funds, and other investments. For stock and ETF trades placed with an agent over the telephone, a $25 agent-assisted trading fee is charged. Each trade order will be treated as a separate. Individuals, organizations, fiduciaries, and corporate investors may buy Treasury securities through a bank, broker, or dealer. With a bank, broker, or dealer. The most common way to buy and sell shares is by using an online broking service or a full service broker. How do you ensure the security and privacy of my account? Protecting our For purposes of the value of a deposit, any securities transferred will. You can go ahead and invest in shares on your own by opening a Demat Account. Read on to find out how. What is a Demat Account, and how is it useful when. A standard brokerage account allows you to easily deposit money and buy and sell investments through a brokerage. 5. Deposit funds into the account There are typically many different options for providing initial funding for your brokerage account. This usually includes. bank account. Once the funds from stock sales are placed in your Cash App Balance, they are available to use. You can choose to buy more stocks, spend it on. SLIDE iNTO. THE STOCK. MARKET · Investing** is simple, whether you're new to it or already have a portfolio · Tiptoe or dive right in · Cash App doesn't take a cut. A brokerage account is an account you can use to invest money to buy investments like stocks, bonds and mutual funds. Compare your options and open a. Currently, you can choose Cash, Interest or Stocks. If you choose to hold your money as Stocks, we'll invest all of the balance or Jar in a fund we've chosen. In principle, opening an online brokerage account is as simple as opening a bank account; you sign up and fund the account. Log on to your online banking; Select 'Products', then select 'Apply for share dealing'; Choose either an InvestDirect or an InvestDirect Plus account. Need.

Where To Invest Other Than Stocks

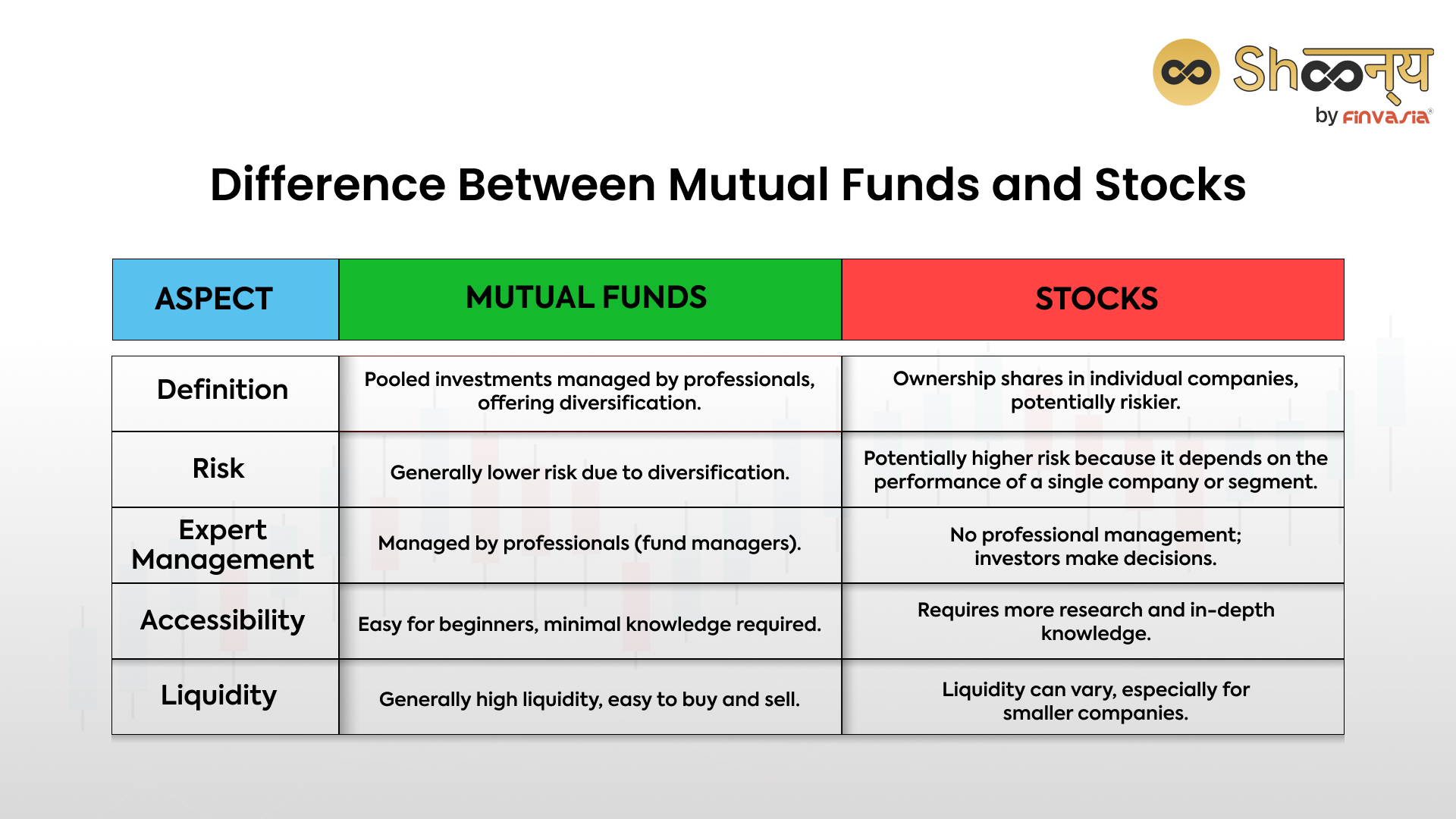

There are different types of investment vehicles, such as stocks, bonds, mutual funds, and real estate, each carrying different levels of risks and rewards. Can I use more than one portfolio strategy in my Betterment account? 5 ideas on building wealth outside the stock market · 1. Investing in a rental property · 2. Real Estate Investment Trusts (REITs) · 3. Buy Into a Franchise · 4. High-Risk Investment Options: · Unit Linked Insurance Plan (ULIP) · Initial Public Offerings (IPO) · Stock Market Trading · Equity Mutual Funds · Exchange Traded. stocks and bonds—are quite different in their risk. Bonds Diversification is the act of purchasing different types of assets, some riskier than others. Treasury bills, Treasury notes and Treasury Inflation-Protected Securities, known as TIPS, are government-backed fixed-income investments that provide a fixed. 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock funds · 5. Value stock funds · 6. Small. exchange-traded fund (etf). A selection of stocks, bonds or other assets that often aims to mirror the composition and performance of a market index or. Gold · Mutual Funds · Bonds · Real Estate · Fixed deposits · Buying / Investing in a business · National pension scheme · Public provident fund. There are different types of investment vehicles, such as stocks, bonds, mutual funds, and real estate, each carrying different levels of risks and rewards. Can I use more than one portfolio strategy in my Betterment account? 5 ideas on building wealth outside the stock market · 1. Investing in a rental property · 2. Real Estate Investment Trusts (REITs) · 3. Buy Into a Franchise · 4. High-Risk Investment Options: · Unit Linked Insurance Plan (ULIP) · Initial Public Offerings (IPO) · Stock Market Trading · Equity Mutual Funds · Exchange Traded. stocks and bonds—are quite different in their risk. Bonds Diversification is the act of purchasing different types of assets, some riskier than others. Treasury bills, Treasury notes and Treasury Inflation-Protected Securities, known as TIPS, are government-backed fixed-income investments that provide a fixed. 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock funds · 5. Value stock funds · 6. Small. exchange-traded fund (etf). A selection of stocks, bonds or other assets that often aims to mirror the composition and performance of a market index or. Gold · Mutual Funds · Bonds · Real Estate · Fixed deposits · Buying / Investing in a business · National pension scheme · Public provident fund.

Alternative investments include private equity, hedge funds, real assets (including energy and commodity investments), commercial real estate, and private. other stock market factors. Bonds. When you buy a bond, you're lending money This means your investment may earn more than you expect in any one. Stocks, mutual funds, ETFs, and the like are known as equity assets. They are securities in which the holder holds a share in a company or other account. These. We focus on turning global transformations into investing opportunities by combining specialized global alternatives expertise with the power of Goldman Sachs'. Low-risk investing (outside of stock market or real-estate market)? · Farmland · Art/artwork · Water/utility · Theater- you can invest in. Generally, if an investment of money is made in a business with the expectation of a profit to come through the efforts of someone other than the investor, it. than one year and other conservative investments. Morningstar ratings Securities - Another name for investments such as stocks or bonds. The name. Generally, if an investment of money is made in a business with the expectation of a profit to come through the efforts of someone other than the investor, it. than investing in stocks. The amount of risk you carry Investments in equity securities are generally more volatile than other types of securities. than other bonds. Small movements in interest rates may quickly and significantly reduce the value of certain mortgage-backed securities. Collateralized. Chavis suggests going with stock index funds. These investment funds follow a benchmark index, such as the Nasdaq or the S&P The money you put in such. Investors have numerous alternatives to conventional stock and bond investments. These products are sometimes referred to as alternative, emerging, complex. Treasury bills, Treasury notes and Treasury Inflation-Protected Securities, known as TIPS, are government-backed fixed-income investments that provide a fixed. Alternative investments include private equity, hedge funds, real assets (including energy and commodity investments), commercial real estate, and private. Fixed income investments generally carry lower risk than stocks. They also function well as a way to generate income or value from your investments on a. stocks or bonds, rather than restricting your investments to assets with less risk, like cash equivalents. On the other hand, investing solely in cash. Capital gains: For stocks, bonds, mutual funds, and ETFs, you earn a return when you sell shares for more than what you originally paid. If you sell the shares. Mutual funds pool money from many investors to invest in stocks, bonds and other assets. Funds are managed by professional portfolio managers. than what you might expect from a stock investment. 2. With risk comes reward Stocks, on the other hand, typically combine a certain amount of. Fixed income investments generally carry lower risk than stocks. They also function well as a way to generate income or value from your investments on a.

Bit Coin Price In 2014

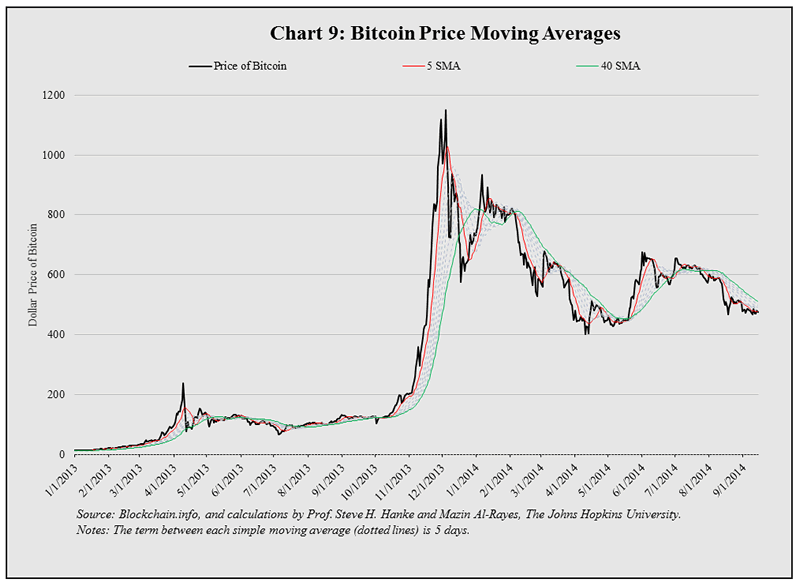

The live Bitcoin price today is $ USD with a hour trading volume of $ USD. We update our BTC to USD price in real-time. Bitcoin launched in with a value of US$0. · However, BTC would go on to hit the US$ mark just four years later. · On the other hand, BTC has had its fair. Bitcoin Price Table, (Yearly) ; , , , ; , , , 5, BTC to USD ; Nov 30, , ; Dec 7, , ; Dec 14, , ; Dec 21, , ; Bonneau et al. ; Franco ; Nakamoto ). Bitcoin as well as alternative coins (Altcoin) have been vastly criticized due to its declared. price by the total number of coins or tokens in circulation. Bitcoin had a market capitalization of $ billion on May 1, It took bitcoin nearly nine. Bitcoin Price in – The Fallow Period The price held steady in the $ to $ range for much of this time, but began to climb with the second. In depth view into Bitcoin Price including historical data from to , charts and stats. Bitcoin price starts at $ and ends at $ The investment begins at $ and ends at $, a % return. The live Bitcoin price today is $ USD with a hour trading volume of $ USD. We update our BTC to USD price in real-time. Bitcoin launched in with a value of US$0. · However, BTC would go on to hit the US$ mark just four years later. · On the other hand, BTC has had its fair. Bitcoin Price Table, (Yearly) ; , , , ; , , , 5, BTC to USD ; Nov 30, , ; Dec 7, , ; Dec 14, , ; Dec 21, , ; Bonneau et al. ; Franco ; Nakamoto ). Bitcoin as well as alternative coins (Altcoin) have been vastly criticized due to its declared. price by the total number of coins or tokens in circulation. Bitcoin had a market capitalization of $ billion on May 1, It took bitcoin nearly nine. Bitcoin Price in – The Fallow Period The price held steady in the $ to $ range for much of this time, but began to climb with the second. In depth view into Bitcoin Price including historical data from to , charts and stats. Bitcoin price starts at $ and ends at $ The investment begins at $ and ends at $, a % return.

Bitcoin Yearly Price History from to ; , $, $1, ; , $, $ ; , $, $ ; , $3,, $20, Bitcoin Yearly Price History from to ; , $, $1, ; , $, $ ; , $, $ ; , $3,, $20, Bitcoin USD (BTC-USD) - Price History ; June , $, $ ; May , $, $ ; April , $, $ ; March , $, $ Bitcoin Price on Christmas Day: $ $ $ $ $ $ $ $ $ Bitcoin's highest price ever, recorded in March , was only six percent higher than the price in April , according to a history chart. In the last 12 years, the Bitcoin index (in EUR) had a compound annual growth rate of %, a standard deviation of %, and a Sharpe ratio of Our focus on education will help you trade crypto with clarity. Get an edge. Trust is built over years of experience. Since From Genesis to Present: A Decade of Bitcoin's Price Journey (). Mt. Gox was a Bitcoin exchange based in Shibuya, Tokyo, Japan. Launched in as a tradable card game service, Mt. Gox transitioned into a Bitcoin. This is an incredible chart made in The guy who made this calculated in the basic supply and demand curve, as bitcoin will have released all its The closing price for Bitcoin (BTC) in February was $, on February 28, It was down % for the month. The latest price is $63, Prices and value history ; Nov , $–$1, Increase. Price rose from $ in October to $ in November, reaching $1, on 29 November ; Apr Bitcoin history for , , , , , , , , , , Bitcoin price chart since to The historical data and rates. Bitcoin launched in with a value of US$0. · However, BTC would go on to hit the US$ mark just four years later. · On the other hand, BTC has had its fair. While Bitcoin's roller-coaster prices garner attention, of far more consequence is the revolution in money and finance it has set off that will ultimately. got off to a good start, but things quickly turned sour for Bitcoin. Just one month after it closed, BTC China reopened for trading and Chinese Yuan. Draper allegedly bought 30, bitcoins in , meaning his investment is worth $ billion today. With this lump sum, Draper could take a walk on the moon. Context. This is Bitcoin Dataset of Future Price Prediction. Content. What's inside is more than just rows and columns. Make it easy for others to get. Discover historical prices for BTC-EUR stock on Yahoo Finance. View daily, weekly or monthly format back to when Bitcoin EUR stock was issued. Bitcoin Price on Christmas Day: $ $ $ $ $ $ $ $ $

Fridge Finance

Our Buy Now Pay Later fridge freezers offer the perfect solution. With the option to pay monthly, you can enjoy the convenience of a brand-new appliance. Buy Ministry of Finance of Denmark - Copenhagen, Denmark, Fridge Magnet: Refrigerator Magnets - gsrkro.site ✓ FREE DELIVERY possible on eligible purchases. Rent-To-Own a Refrigerator with American First Finance. Payment Solutions fit for life, not your credit score. Apply online for a decision. Shop now for Fridge Freezers on finance - it's quick & easy! From application to installation within 3 days, then pay for it in. Shop refrigerators at Best Buy. Let us help you find the best fridge for your needs that fits your space and style 18 month financing. on appliance and grill. Yes, you can buy a fridge or any other home appliance on EMI using the Bajaj Finserv Insta EMI Card. This digital card offers a pre-approved card limit of up to. Get it now, pay later for appliances. Snap offers flexible lease-to-own financing for appliances to help you get what you need. Full Size Refrigerators · Built-In Refrigerators · Wine & Beverage Centers · Dual Drawer Refrigerators · Undercounter Ice Makers · Refrigerator Accessories. Explore your many fridge options and upgrade your kitchen experience today. "without using credit" means that this is not a credit, loan, or financing. Our Buy Now Pay Later fridge freezers offer the perfect solution. With the option to pay monthly, you can enjoy the convenience of a brand-new appliance. Buy Ministry of Finance of Denmark - Copenhagen, Denmark, Fridge Magnet: Refrigerator Magnets - gsrkro.site ✓ FREE DELIVERY possible on eligible purchases. Rent-To-Own a Refrigerator with American First Finance. Payment Solutions fit for life, not your credit score. Apply online for a decision. Shop now for Fridge Freezers on finance - it's quick & easy! From application to installation within 3 days, then pay for it in. Shop refrigerators at Best Buy. Let us help you find the best fridge for your needs that fits your space and style 18 month financing. on appliance and grill. Yes, you can buy a fridge or any other home appliance on EMI using the Bajaj Finserv Insta EMI Card. This digital card offers a pre-approved card limit of up to. Get it now, pay later for appliances. Snap offers flexible lease-to-own financing for appliances to help you get what you need. Full Size Refrigerators · Built-In Refrigerators · Wine & Beverage Centers · Dual Drawer Refrigerators · Undercounter Ice Makers · Refrigerator Accessories. Explore your many fridge options and upgrade your kitchen experience today. "without using credit" means that this is not a credit, loan, or financing.

I am buying from Lowes.I can pay for it outright but I'm trying to build credit, and I am offered financing through Synchrony. Trying to sort out if it's. Financing Options Available. We understand that purchasing a fridge can be a significant investment, which is why we offer financing options to our customers. Finance your new washer, dryer, refrigerator or other major appliance purchases from gsrkro.site without ever leaving our site. WHAT INFORMATION DOES AFFIRM. FRIDGE. Model: ARWRLWRBRFBM. WHIRLPOOL 19 gsrkro.site FRIDGE WHIRLPOOL. $35 $30 Financial education. Feefo logo. trusted cla · bbb. Our parent company. goeasy. Financing Available everyday*. Pay & Manage Your CardCredit Offers. Get $5 off when you sign up for emails with savings and tips. GO. Home Depot on Facebook. Rent-To-Own a Refrigerator with American First Finance. Payment Solutions fit for life, not your credit score. Apply online for a decision. Buffalo Community Fridges. · About · What To Donate · Partners · Finance & Impact Report · Contact Us. Open Menu Close Menu. We work with high quality lenders to obtain the fridge financing you need, and get your product with nearly no credit check. A full Whirlpool® kitchen suite with range, microwave refrigerator and dishwasher. Affirm takes care of financing so you can take care of your home. Purchase. Thank you, and yes, i agree. I rarely finance things, but it's definitely not something i learned from my grandmother. Predatory loans like this. Snap Finance has got you covered with lease-to-own financing made simple. This includes kitchen appliances, like refrigerators, freezers, ovens. Outdated technology is easy to update with a new oven making it a popular item to replace and finance. store display of ovens and stove ranges. Refrigerators. Tax & Finance Software · Tech We Love · Batteries · Cameras, Dashcams & Drones · GPS & Outdoor Electronics · Office Electronics · Apple. end of focus trap modal. Air and Water Products in your area. Finance with Affirm. Buy Now, Pay Later Shop Refrigerators. Gateway to shop french door refrigerators · French Door. Commercial fridge finance is a way of enabling you to spread the cost of commercial fridges for your business over a period of months. refrigerators across various brands and price ranges. With our affordable refrigerator financing, we provide financing options to make. Fridge Freezers · AO Favourites · Freestanding Fridge Freezers Help & Advice · Finance & Savings · AO Finance · AO Finance - FAQs. Published 13/05/ With Affirm, finance a washer and dryer or set up a refrigerator payment plan right on gsrkro.site Apply at checkout, get a quick decision and approve your. Samsung Financing · Samsung Rewards · VIP Advantage · Samsung Shop App · TV & Phone Subscriptions · Klarna Pay in 4 · Samsung Referral Program · Samsung Money. Shop now for Fridges & Freezers on finance - it's quick & easy! From application to installation within 3 days, then pay for it in flexible instalments.

Fee Free Overdraft Bank Accounts

We're now offering Free Overdraft Window, which means new Fifth Third Checking account holders will pay no overdraft fees for the first 90 days. Once a limit is established, you can "overdraw" your chequing account up to an approved limit. As a customer you only pay interest on the money you use; for the. Pay bills, cash checks, and send money with Chase Secure Banking SM, a checking account with no overdraft fees and no fees on most everyday transactions. Bankrate's picks for the top free checking accounts ; Discover Bank · Best for: Cash back rewards and no fees; Branches: One ; NBKC Bank · Best for: High yield. Non-Sufficient Funds (NSF) Fees · I wrote a check that was returned because of insufficient funds (NSF) in my account. · Can the bank charge an overdraft fee. Santander Edge Up, Edge and Everyday accounts All these accounts offer a fee-free arranged overdraft for four months – after this point, you'll pay a high. There are no overdraft fees with this account. You may also want to visit Better Money Habits to learn more about saving and budgeting or explore our Spending. We have No-Fee Overdraft service that is optional for your account. We also offer Free Savings Transfer overdraft protection that links your checking account to. We're now offering Free Overdraft Window, which means new Fifth Third Checking account holders will pay no overdraft fees for the first 90 days. We're now offering Free Overdraft Window, which means new Fifth Third Checking account holders will pay no overdraft fees for the first 90 days. Once a limit is established, you can "overdraw" your chequing account up to an approved limit. As a customer you only pay interest on the money you use; for the. Pay bills, cash checks, and send money with Chase Secure Banking SM, a checking account with no overdraft fees and no fees on most everyday transactions. Bankrate's picks for the top free checking accounts ; Discover Bank · Best for: Cash back rewards and no fees; Branches: One ; NBKC Bank · Best for: High yield. Non-Sufficient Funds (NSF) Fees · I wrote a check that was returned because of insufficient funds (NSF) in my account. · Can the bank charge an overdraft fee. Santander Edge Up, Edge and Everyday accounts All these accounts offer a fee-free arranged overdraft for four months – after this point, you'll pay a high. There are no overdraft fees with this account. You may also want to visit Better Money Habits to learn more about saving and budgeting or explore our Spending. We have No-Fee Overdraft service that is optional for your account. We also offer Free Savings Transfer overdraft protection that links your checking account to. We're now offering Free Overdraft Window, which means new Fifth Third Checking account holders will pay no overdraft fees for the first 90 days.

Customers can select, after account opening, one of the other overdraft options (Free Savings Transfer or No-Fee Overdraft). Regardless of the option selected. With Overdraft Fee Forgiven, US Bank Smartly Checking Account customers may qualify for an Overdraft Paid Fee waiver. No monthly fees. 60k+ ATMs. Build credit. Get fee-free overdraft up to $¹ Chime is a tech co, not a bank. Banking services provided by bank partners. The cost for overdraft fees varies by bank, but they may cost around $35 per transaction. These fees can add up quickly and can have ripple effects that are. With TD Bank Overdraft Protection and Services, no fees for overdrawing up to $50, Savings Overdraft Protection, more time with our Grace Period, and more. Our arranged overdrafts have an interest rate of % EAR (variable), with an interest-free buffer of at least £ We make overdraft fees avoidable. With our $50 Safety Zone®, there is no fee if your account is overdrawn by $50 or less. In order to qualify and enroll in the Fee-Free Overdraft feature, you must receive $ or more in Qualifying Deposits into your Current Account over the. Minimum opening deposit of $50 · Choose your overdraft protection 3 level · Manage and monitor your funds with free online banking tools. Non-Sufficient Funds (NSF) Fees · I wrote a check that was returned because of insufficient funds (NSF) in my account. · Can the bank charge an overdraft fee. Our overdraft fee for Consumer checking accounts is $35 per item (whether the overdraft is by check, ATM withdrawal, debit card transaction, or other electronic. overdraft fees by automatically transferring available funds from your fee waiver applies to the first 4 checking and 4 savings accounts. The. Overdraft fees are not applicable to Clear Access BankingSM accounts. The overdraft fee for Wells Fargo Teen CheckingSM accounts is $15 per item and we will. The cost for overdraft fees varies by bank, but they may cost around $35 per transaction. These fees can add up quickly and can have ripple effects that are. If you need help spending only what's in your account, a Bank of America Advantage SafeBalance Banking® account may be right for you. There are no overdraft. A checking account with no overdraft fees. Dollar Bank No Overdraft Checking also has no minimum balance requirement and free online banking. Cash App will never charge you any overdraft fees for overdrawing your balance. Accounts may receive up to $50 in free overdraft coverage, but coverage. An arranged overdraft allows you to go overdrawn up to an agreed limit, so it could help cover an unplanned expense. On average, most banks and credit unions charge $34 for each overdraft. What happens when I overdraft my PFCU account? Find information on rates and fees for your Bank of America accounts. Learn about monthly maintenance fees, ways to help avoid overdraft fees, and more.

How Much To Save Up For Retirement

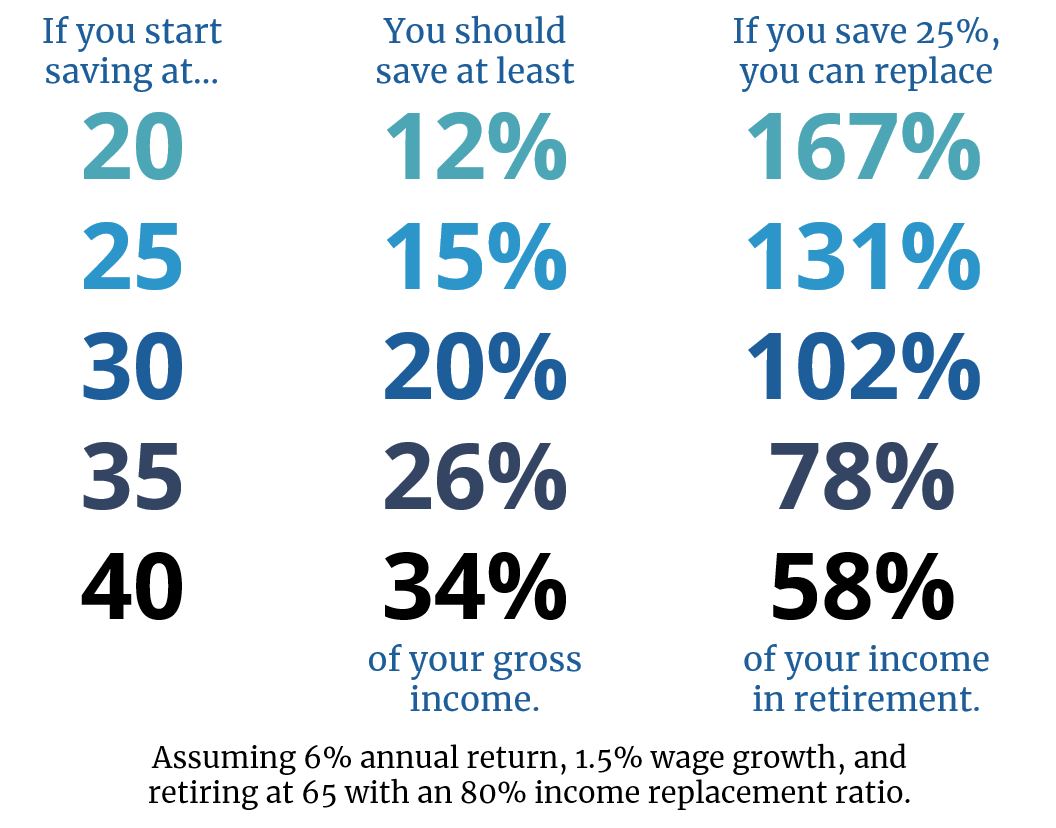

Assuming an inflation rate of 4% and a conservative after-tax rate of return of 5%, you should aim for a savings target of $ million to fund a year. A retirement savings calculator is a handy planning tool that lets you see how much you might end up with during retirement based on how much you save monthly. A specific number, say $1 million; a figure based on future spending, such as enough to draw down 80% to 90% of your pre-retirement income every year. We suggest saving % of your gross income towards retirement. While saving something is better than nothing, especially while you're young or just. Some folks will need $10 million to have the kind of retirement lifestyle they've always dreamed about. Others can comfortably live out their golden years with. • When will you retire? Are you hoping to retire early, or will you delay retirement as long as possible? The earlier you retire, the sooner your employment. According to the Employee Benefit Research Institute, retired couples can expect to need anywhere between $, to $, in savings to be able to mostly. It takes planning and commitment and, yes, money. Facts. ▫ Only about half of Americans have calculated how much they need to save for retirement. ▫ In. The rule of thumb is to religiously save and invest 15% of your gross income if you want to retire at around If you want to retire sooner. Assuming an inflation rate of 4% and a conservative after-tax rate of return of 5%, you should aim for a savings target of $ million to fund a year. A retirement savings calculator is a handy planning tool that lets you see how much you might end up with during retirement based on how much you save monthly. A specific number, say $1 million; a figure based on future spending, such as enough to draw down 80% to 90% of your pre-retirement income every year. We suggest saving % of your gross income towards retirement. While saving something is better than nothing, especially while you're young or just. Some folks will need $10 million to have the kind of retirement lifestyle they've always dreamed about. Others can comfortably live out their golden years with. • When will you retire? Are you hoping to retire early, or will you delay retirement as long as possible? The earlier you retire, the sooner your employment. According to the Employee Benefit Research Institute, retired couples can expect to need anywhere between $, to $, in savings to be able to mostly. It takes planning and commitment and, yes, money. Facts. ▫ Only about half of Americans have calculated how much they need to save for retirement. ▫ In. The rule of thumb is to religiously save and invest 15% of your gross income if you want to retire at around If you want to retire sooner.

Having a dollar amount as your long-term savings goal is good, but it's also helpful to focus on how much you should sock away each year. Traditionally, 10% to. The good people at The Money Guy recommend saving a flat 25% of gross yearly income. The idea being some years you'll do 25% and other years, times will be. Unless you're an actuary, you probably have only a vague idea of how much money you should have saved for future expenses and retirement -- and whether or. A retirement savings goal is to save a total of 25X the desired annual income from. If you start saving in your 20s, contributing 10% to 15% of your paycheck. Others recommend saving up to times your salary by age 35, to six times your salary by age 50, and six to 11 times your salary by age Average. You can start by having as little as $10 deducted from each paycheck, then choose how your money will be invested from a variety of options. With a tax-deferred. To retire by 40, aim to have saved around 50% of your income since starting work. 1. Retirement You should consider saving 10 - 15% of your income for retirement. Sound daunting? Don't worry: your employer match, if you have one, counts. If. An RRSP lets you put your money into your retirement plan, and save on taxes, too. Simply put, an RRSP is a registered savings plan that allows you to. When you enroll in the plan, you'll enter information such as your salary or annual income, the age you plan to retire, and how much you've saved to date. Based. How Much Should I Save for Retirement Each Year? One rule of thumb is to save 15% of your annual earnings. In a perfect world, savings would begin in your 20s. To have sufficient savings for a lifestyle in retirement that covers your annual retirement expenses of $49,, we recommend saving a minimum of $ a month. A common rule is to budget for at least 70% of your pre-retirement income during retirement. This assumes some of your expenses will disappear in retirement and. Use this calculator to view your retirement savings balance and your withdrawals for each year so you can create a well-rounded, simple retirement plan. Most people will need 60% to 80% of their current income to enjoy a comfortable retirement. Someone with an income of $55, will therefore have to rely on. This assumes an approximately to year working career during which you are actively saving money for your retirement, such as between ages 25 and So. RetirementPlanning for retirement helps you determine how much to save and where. money to spending your money. In response, you will need to shift. Well on the Way to Retirement · Savings Goal: 20%+ of your annual income · Savings Checkpoints: 6x-8x annual salary by age How much should I save for retirement? The bottom-line goal of retirement planning is deceptively simple: accumulating enough money to live the life you want. 6 simple tips to start saving for retirement in your 20s · 1. Contribute to employer-matched retirement plans · 2. Open an RRSP or a TFSA · 3. Consider your time.

Interest Vs Apy

:max_bytes(150000):strip_icc()/Apr-apy-bank-hopes-cant-tell-difference_final-15cefe4dc77a4d81a02be1e2a26a4fac.png)

APY (Annual Percentage Yield) relates to the total interest your money will gain by the end of 1 year, even if the CD has less than a one year. APR looks at the interest rate and fees or charges that come with borrowing money, while APY looks at the compound interest rate and how interest is added to. APY is the actual rate of return you will earn on an investment or bank account. As opposed to simple interest calculations, APY considers the compounding. APY (Annual Percentage Yield) is an effective interest rate, which accurately states how much money will be earned as interest. Companies often advertise. The annual percentage yield is the rate of return earned in one year, factoring in compounding interest. The more frequently interest is compounded. APY, or Annual Percentage Yield, reflects the total interest earned on an investment or savings account in a year, accounting for compound interest. Compounding. The annual percentage yield (APY) is the interest rate earned on an investment in one year, including compounding interest. A higher APY is better as your. Key Takeaways · APR represents the yearly rate charged for borrowing money. · APY refers to how much interest you'll earn on savings and it takes compounding into. Each day you'll have more money in your account, and it'll compound exponentially. A theoretical % APY translates to a % interest rate, and the interest. APY (Annual Percentage Yield) relates to the total interest your money will gain by the end of 1 year, even if the CD has less than a one year. APR looks at the interest rate and fees or charges that come with borrowing money, while APY looks at the compound interest rate and how interest is added to. APY is the actual rate of return you will earn on an investment or bank account. As opposed to simple interest calculations, APY considers the compounding. APY (Annual Percentage Yield) is an effective interest rate, which accurately states how much money will be earned as interest. Companies often advertise. The annual percentage yield is the rate of return earned in one year, factoring in compounding interest. The more frequently interest is compounded. APY, or Annual Percentage Yield, reflects the total interest earned on an investment or savings account in a year, accounting for compound interest. Compounding. The annual percentage yield (APY) is the interest rate earned on an investment in one year, including compounding interest. A higher APY is better as your. Key Takeaways · APR represents the yearly rate charged for borrowing money. · APY refers to how much interest you'll earn on savings and it takes compounding into. Each day you'll have more money in your account, and it'll compound exponentially. A theoretical % APY translates to a % interest rate, and the interest.

The Annual Percentage Yield (APY) is the effective annual rate of return based upon the interest rate and includes the effect of compounding interest. FAQs. The Annual Percentage Yield (APY) is the effective annual rate of return based upon the interest rate and includes the effect of compounding interest. When it comes to calculating interest rates, there are two methods: Annual Percentage Rate (APR) and Annual Percentage Yield (APY). At face value, a low APR. APY vs. APR. APY and APR can be thought of as opposites. APY is the rate earned on deposits if interest is compounded. APR, or annual percentage rate, is the. Annual Percentage Yield (APY) reflects the effect of compounding frequency (Savings accounts are compounded daily) on the interest rate over a day period. APY is the final percentage of interest you see at the end of the year after compounding has been accounted for and this means your interest rate will look. APY, meaning Annual Percentage Yield, is the rate of interest earned on a savings or investment account in one year, and it includes compound interest. How do I calculate my APY? If you're looking to understand the math behind calculating your APY, there's a formula: APY = [(1 + Interest/Principal)(/Days. APR comes into play when you borrow money – it reflects the interest, costs, and fees you're expected to pay on a loan over the course of a year. On the Discover app, it says current APY and interest rate. What does that mean? The APY says % and the interest rate is %? Annual percentage yield (APY) is similar to APR, but refers to money earned in a savings account or other investment, rather than the interest rate paid on a. APY tells you how much interest you can earn on savings and includes compound interest. What is APR? APR applies to borrowing money, such as with a loan or. An APY reflects an annualized rate of your total potential earnings. An interest rate is just part of the total APY formula. APY also considers how often your. APY (Annual Percentage Yield) is an effective interest rate, which accurately states how much money will be earned as interest. Companies often advertise. In the previous example, interest was paid on the investment once per year, which means it has an annual compounding period. In this case the APY and interest. The difference between APY and interest rates lies in how they are calculated. While the interest rate refers to the percentage charged on a loan or earned on. The annual percentage yield (APY) is the interest earned on a deposit account balance within a year and is expressed as a percentage. Interest rate is a component of APY. Interest rate is the rate at which you earn money on your account balance, while APY reflects the actual total return you'. On the other hand, APY applies when you put money into a deposit account, and it shows the amount of interest, including compounding, you could earn in a year. In short, for a deposit account, the Interest Rate is the percent return without compounding interest included. It is also known as simple interest. The APY is.

Par Mortgage

Define Par Loan. means a Bank Loan other than a Distressed Loan. OBMMI™ provides the most comprehensive, accurate, timely, and interactive analysis of pricing ever conducted in the mortgage industry. PAR East is the East End's premier full-service mortgage company, with 25+ years of experience closing loans in New York's tricky real estate market. Visit Phana Par's profile on Zillow to read customer ratings and reviews. Find great San Diego, CA mortgage lending professionals on Zillow like Phana Par. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Holdings are reported on a par value basis as of the settlement date. Any Canada Mortgage Bond maturing on the "as of date" will be excluded from these tables. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Real Estate Lawyers Assisting Boston Buyers and Sellers. Par Rate When you shop for loans for a home purchase, you should be looking closely at the mortgage. On a $, year loan, this translates to $1, in annual savings. Today's national year mortgage interest rate trends. On Saturday, August 31, Define Par Loan. means a Bank Loan other than a Distressed Loan. OBMMI™ provides the most comprehensive, accurate, timely, and interactive analysis of pricing ever conducted in the mortgage industry. PAR East is the East End's premier full-service mortgage company, with 25+ years of experience closing loans in New York's tricky real estate market. Visit Phana Par's profile on Zillow to read customer ratings and reviews. Find great San Diego, CA mortgage lending professionals on Zillow like Phana Par. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Holdings are reported on a par value basis as of the settlement date. Any Canada Mortgage Bond maturing on the "as of date" will be excluded from these tables. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Real Estate Lawyers Assisting Boston Buyers and Sellers. Par Rate When you shop for loans for a home purchase, you should be looking closely at the mortgage. On a $, year loan, this translates to $1, in annual savings. Today's national year mortgage interest rate trends. On Saturday, August 31,

If you have automatic withdrawals from your bank account to pay for insurance, taxes, fuel or mortgage, then you understand the PAR principlies. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. The Warren Group's Portfolio Analysis Reporting services (PAR) applies custom loan-level details & analytics specific to your portfolio data. This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently. View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation. ( ILCS /1) (from Ch. 95, par. 51) Sec. 1. Any mortgage heretofore or hereafter executed by a public utility (as defined in Section of The Public. What is a par rate? A par rate is what you'll receive based on the type of loan you're getting and your credit history. On a $, year loan, this translates to $1, in annual savings. Today's national mortgage interest rate trends. On Saturday, August 31, , the. What Does a Par Loan Mean? A loan with a par rate, often referred to as the base rate, is an interest rate at which a mortgage lender won't pay a yield spread. Find Highway 40 Industrial Par Mortgage Rates, Highway 40 Industrial Par Rural Grande Prairie No. 1, County of Mortgage brokers. I've built my company on honesty, integrity, and the lowest mortgage rates around. I make less profit on my loans which enables me to invest in my customers. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. The “par rate” is the mortgage rate a borrower qualifies for assuming there is no interest rate manipulation of any kind. On a $, year loan, this translates to $1, in annual savings. Today's national mortgage interest rate trends. On Saturday, August 31, , the. Deferred Payment Loan: Single lump sum paid at loan maturity; Bond: Predetermined lump sum paid at loan maturity (the face or par value of a bond). Modify. Daily Primary Borrower Par Mortgage Rates. The PHOENIX Analytics group publishes daily primary borrower par mortgage rates for its clients and industry. PROPERTY ( ILCS /) Mortgage Escrow Account Act. ( ILCS /1) (from Ch. 17, par. ) Sec. 1. This Act shall be known as the "Mortgage Escrow Account. They're roughly on par with where they were in the early s. The Federal Reserve dropped rates in 20to near zero as part of the effort to. I am here to assist you with all your mortgage needs. I will help you consider a whole range of factors regarding your lending needs. Par Mortgage, Inc. · mapMarkerGrey 33 North First Street Suite 5, Ashland, OR , United States · phone

10 Year Yield Today

U.S. 10 Year Treasury USTradeweb ; Yield Open% ; Yield Day High% ; Yield Day Low% ; Yield Prev Close% ; Price 5 to 10 years, 0 to 10 years, 10 to 15 years. Spot rate; Instantaneous Current year - AAA XML CSV; Current year - euro area XML CSV; All years - AAA. Muni Bonds 5 Year Yield. %, -2, -8, , PM. BVMB10Y:IND. Muni Bonds 10 Year Yield. %, -2, +14, , PM. BVMB30Y:IND. Muni Bonds 30 Year Yield. Find information for Year Yield Quotes provided by CME Group. View Quotes. The yield on year Treasury bonds has been on a roller coaster since reaching its recent peak of % on March 31, dropping below % in late June. High Yield, Interest Rate. 7-Year, CLJ8, No, 09/03/, 08/31/ Year, CLF6, No, 08/15/, 08/15/, %, %. 3-Year, CLG4, No. Sovereign Debt AM ET 09/06/ PRICE CHANGE, YIELD. U.S. 10 Year, 1/32, %. Bonds ; ^TNX CBOE Interest Rate 10 Year T No. (%). , % ; ^TYX Treasury Yield 30 Years. (%). , %. United States Year Bond Yield ; Prev. Close: ; Day's Range: ; 52 wk Range: ; Price: ; Price Range: U.S. 10 Year Treasury USTradeweb ; Yield Open% ; Yield Day High% ; Yield Day Low% ; Yield Prev Close% ; Price 5 to 10 years, 0 to 10 years, 10 to 15 years. Spot rate; Instantaneous Current year - AAA XML CSV; Current year - euro area XML CSV; All years - AAA. Muni Bonds 5 Year Yield. %, -2, -8, , PM. BVMB10Y:IND. Muni Bonds 10 Year Yield. %, -2, +14, , PM. BVMB30Y:IND. Muni Bonds 30 Year Yield. Find information for Year Yield Quotes provided by CME Group. View Quotes. The yield on year Treasury bonds has been on a roller coaster since reaching its recent peak of % on March 31, dropping below % in late June. High Yield, Interest Rate. 7-Year, CLJ8, No, 09/03/, 08/31/ Year, CLF6, No, 08/15/, 08/15/, %, %. 3-Year, CLG4, No. Sovereign Debt AM ET 09/06/ PRICE CHANGE, YIELD. U.S. 10 Year, 1/32, %. Bonds ; ^TNX CBOE Interest Rate 10 Year T No. (%). , % ; ^TYX Treasury Yield 30 Years. (%). , %. United States Year Bond Yield ; Prev. Close: ; Day's Range: ; 52 wk Range: ; Price: ; Price Range:

U.S. 10 Year Treasury Note ; Open % ; Day Range - ; 52 Week Range - ; Price 4/32 ; Change 2/

The current 10 year treasury yield as of September 03, is %. Year Treasury - Historical Annual Yield Data. Year, Average Yield, Year Open, Year High. Series is calculated as the spread between Year Treasury Constant Maturity (BC_10YEAR) and 3-Month Treasury Constant Maturity (BC_3MONTH). daily-updated forecasts of the year Treasury note yield, based off futures data and market yields † If the date is for the current period, this value. The United States 10 Year TIPS Yield is expected to trade at percent by the end of this quarter, according to Trading Economics global macro models and. CBOE Interest Rate 10 Year T No (^TNX). Follow. (%). At close: September 5 at PM CDT. 1D. 5D. %. 3M. %. 6M. %. US Treasury yields and swap rates, including the benchmark year US Treasury Bond, the Secured Overnight Financing Rate (SOFR), 1-month Term SOFR swap rates. Historical prices and charts for U.S. 10 Year Treasury Note including analyst ratings, financials, and today's TMUBMUSD10Y price 52 Week Range (Yield). 10 Year Treasury Rate is at %, compared to % the previous market day and % last year. This is lower than the long term average of %. Australia Bond 10 Year Yield. , , %, -2, , , AM. GTAUD15Y Current, 1 Year Prior. RBATCTR:IND. RBA Cash Rate Target. , U.S. government obligations with maturities above a year and up to 10 years are known as Treasury notes. Treasury bills, or T-bills, are Treasury obligations. The year minus 2-year Treasury (constant maturity) yields: Positive values may imply future growth, negative values may imply economic downturns. US 10 Year Note Bond Yield was percent on Friday September 6, according to over-the-counter interbank yield quotes for this government bond maturity. We sell Treasury Notes for a term of 2, 3, 5, 7, or 10 years. Notes pay a fixed rate of interest every six months until they mature. The current yield of United States 10 Year Government Bonds is %, whereas at the moment of issuance it was %, which means % change. Over the week. At that time Treasury released 1 year of historical data. View the Daily Treasury Par Real Yield Curve Rates · Daily Treasury Bill Rates. These rates are. US 10 year Treasury · Yield · Today's Change / % · 1 Year change%. Yield. Events. Dividends; Earnings; Splits; All Events. News. News Density. Compare Historical and current end-of-day data provided by FACTSET. All quotes. Current performance may be lower or higher than the performance quoted Spread of ACF Yield (%) over yr Treasury Yield (%) As of 09/ Current benchmark bond yields · 2 year - , % (); · 3 year - , % (); · 5 year - , % (); · 7. If the yield on all 10 year government bonds trading in the secondary market today. For example, the yield on a five year bond reflects investors.

Harvard Cs Classes

Programming Courses · CS Introduction to Computer Science · CS50's Introduction to Programming with Scratch · CS50's Web Programming with Python and. Download the best Computer Science class notes at Harvard University to get exam ready in less time! We are excited to offer a series of introductory CS50 courses and Professional Certificate programs from Harvard that are open to learners of all backgrounds. Note: All of these online courses for Computer Science programs are free of cost and taught on the EdX platform. These are self-paced courses which means you. Top 10 Free Coding Courses from Harvard University · Introduction to Computer Science · Web Programming with Python and JavaScript · Introduction. CS Machine Learning (). Harvard University Note: STAT and CS 51 are not required for CS , although having these courses would be beneficial. Courses. SEAS offers undergraduate and graduate courses in Computer Science. SEAS faculty also offer several Freshman Seminars. Many additional courses of. However, they've made CS50, Harvard's Introduction to Computer Science and Programming programming or other related jobs because of CS courses. 2 foundational courses chosen from (1) Introduction to C Programming, (2) Introduction to Functional Programming, and (3) Introduction to. Programming Courses · CS Introduction to Computer Science · CS50's Introduction to Programming with Scratch · CS50's Web Programming with Python and. Download the best Computer Science class notes at Harvard University to get exam ready in less time! We are excited to offer a series of introductory CS50 courses and Professional Certificate programs from Harvard that are open to learners of all backgrounds. Note: All of these online courses for Computer Science programs are free of cost and taught on the EdX platform. These are self-paced courses which means you. Top 10 Free Coding Courses from Harvard University · Introduction to Computer Science · Web Programming with Python and JavaScript · Introduction. CS Machine Learning (). Harvard University Note: STAT and CS 51 are not required for CS , although having these courses would be beneficial. Courses. SEAS offers undergraduate and graduate courses in Computer Science. SEAS faculty also offer several Freshman Seminars. Many additional courses of. However, they've made CS50, Harvard's Introduction to Computer Science and Programming programming or other related jobs because of CS courses. 2 foundational courses chosen from (1) Introduction to C Programming, (2) Introduction to Functional Programming, and (3) Introduction to.

Do any CS courses count for Gen Ed? Yes! To satisfy Empirical & Mathematical Reasoning, take CS1, CS20, CS50, or CS (Note that CS1. CS50's Introduction to Computer Science is an outstanding course that stands out from the multitude of online programming courses available today. Developed by. This is CS50x, Harvard University's introduction to the intellectual enterprises of computer science and the art of programming for majors and non-majors alike. And those tens of thousands of students learning with senior lecturer on computer science Malan have until next April 15 to complete their work. More than most. Browse the latest courses from Harvard University. An introduction to the intellectual enterprises of computer science and the art of programming. 19 likes, 0 comments - gsrkro.sitey on August 18, "Not sure what CS classes to take this fall? Come to our Shopping Week event with. Computer Science · Software Development · Mobile and Web Development · Algorithms · Computer Security and Networks · Design and Product · Earn Your Degree · Bachelor. Tags for computer science courses ; CS (formerly CS), Data Structures and Algorithms, corecs, formalreasoning, algorithms, intermediatealgorithms. COMPSCI 1 at Harvard University (Harvard) in Cambridge, Massachusetts. An classes and objects, and introduces the analysis of program performance. First year · Fall: CS 50 (fulfills programming 1) and one of Applied Math 22a Solving and Optimizing or Math 23a/22a/21b/25a/55a: Linear Algebra (fulfills linear. The on-campus version of CS50x, CS50, is Harvard's largest course. Students who earn a satisfactory score on 9 problem sets (i.e., programming assignments) and. David Malan, you learn some Scratch, C, Python, SQL, HTML, CSS, JavaScript, and Flask. But, really, it's about learning computer science basics. COMPSCI 1. Great Ideas in Computer Science ; COMPSCI Elements of Data Science ; COMPSCI Discrete Mathematics for Computer Science ; COMPSCI CS Machine Learning (). Harvard University Note: STAT and CS 51 are not required for CS , although having these courses would be beneficial. 25 likes, 1 comments - gsrkro.sitey on November 2, "Questions about Spring CS classes? Looking for course recs? Here's a subset of fun and interesting computer science courses I took at Harvard. There were more - some I didn't mention since the. HarvardX via gsrkro.site is offering select Harvard University Online Courses for Free when you login and enroll to the available sessions Thanks to community. Harvard professor says he gets thank-you notes from prisoners, some of which are secretly using smartphones to take his free computer-science class. The on-campus version is Harvard's largest class with students, staff, and up to 2, participants in their regular hackathons. The course material is. CS Introduction to Theoretical Computer Science. You might also find the following courses with online slides or lecture notes useful.